Shareholders and investors

13 March 2025

BCGE share price :

CHF 261

Volume traded :

868 shares

BCGE ticker references

Stock market listing: SIX Swiss ExchangeReuters: BCGE.S

Bloomberg: BCGE SW

Telekurs: BCGE

Security number: 35 049 471

ISIN number: CH0350494719

Historic

| Price extremes CHF | 2014 | 2015 | 2016 | 2017* | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Highest price

|

234.90

|

261.75

|

298.00

|

163.90

|

197.50

|

204.00

|

204.00

|

175.00

|

182.00

|

229.00 |

317.00 |

|

Lowest price

|

208.00

|

214.00

|

258.25

|

147.60

|

162.00

|

192.00

|

157.00

|

153.00

|

159.00

|

177.00 |

222.00 |

|

Closing price

|

|

|

|

|

|

|

|

161.00

|

179.50

|

225.00 |

255.00 |

Dividend

| Date | % of par value | Gross amount -35 | -35% witholding tax | Net amount |

|---|---|---|---|---|

|

3 May |

9.8 % |

CHF 4.90 ** |

CHF 1.715 |

CHF 4.785 |

|

8 mai |

8.3 % |

CHF 4.15 |

CHF 1.4525 |

CHF 4.0475 |

|

13 May |

6.8 % |

CHF 3.40 |

CHF 1.19 |

CHF 3.31 |

|

7 May |

5.6% |

CHF 2.80 |

CHF 0.98 |

|

|

12 May |

5.6% |

CHF 2.80 |

CHF 0.98 |

|

|

7 May |

6.8% |

CHF 3.40 |

CHF 1.19 |

CHF 2.21 |

|

9 May |

5.8% |

CHF 2.90 |

CHF 1.015 |

CHF 1.885 |

|

2 May |

5.50% |

CHF 2.75 |

CHF 0.9625 |

CHF 1.78 |

|

3 May |

5.50% |

CHF 5.50 |

CHF 1.925 |

CHF 3.575 |

|

28 April |

5% |

CHF 5.- |

CHF 1.75 |

CHF 3.25 |

|

8 May |

4.50% |

CHF 4.50 |

CHF 1.575 |

CHF 2.925 |

* The single registered share was introduced in 2017 and its nominal value divided by two.

** The dividend of CHF 6.50 consists of an ordinary dividend of CHF 4.90 per share and an additional amount of CHF 1.60 per share which is taken from the capital reserves.

*** Ex date dividende 30.04.2024/ Record date 03.05.2024

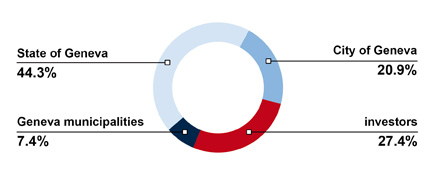

Shareholder

Ordinary stocks, CHF 50 nominal : 7'200’000

Summary notes of BCGE’s 29th Annual General Meeting (French only)

The 2025 General Meeting will be held on 29 April 2025.

At the AGM on 26 April 2016, BCGE shareholders adopted amendments to the Articles of Association required for introduction of a single registered share. Following ratification by Geneva's Grand Council, the new Articles of Association came into force on 28 January 2017.

Each listed bearer share with a par value of CHF 100 was converted into two registered shares with a par value of CHF 50. Unlisted A and B registered shares with a par value of CHF 50 each were also converted into new registered shares (in a 1-for-1 exchange ratio). Each new registered share entitles the shareholder to one vote. Listing of the new registered shares has been authorised by SIX Swiss Exchange.

- FAQ (French only)

- Mail to shareholders (French only)

- Registration form in the Register of shareholders (French only)

- Articles of Association (French only)

- Advertisement

- Press release: Conversion of BCGE's share capital

Amendment of the Law on Banque Cantonale de Genève

The Law on Banque Cantonale de Genève (LBCGe), which came into force on 1 April 2016, now makes provision for the Bank's capital to be divided into registered shares of identical par value, each share giving the right to one vote. On 26 April 2016, the AGM of BCGE shareholders adopted amendments to the Bank's Articles of Association in order to reflect this amendment of the LBCGe. In particular, the new Articles of Association set the par value of the registered share at CHF 50.These amendments to the Articles of Association were formally approved by FINMA and ratified by the Grand Council of the Republic and Canton of Geneva. They came into force on 28 January 2017, enabling the effective conversion of the shares to go ahead.It should be borne in mind that the purpose of introducing a single share is to boost the liquidity and attractiveness of the share on the capital market, enhance the transparency of the shareholding structure, relinquish bearer shares pending future changes to Swiss legislation, and facilitate compliance with the new regulatory requirements.

Automatic conversion of the shares

The three previous share categories have been replaced by a single category of registered shares listed on the SIX Swiss Exchange. This conversion was done automatically and has required no action by shareholders themselves. Each bearer share with a par value of CHF 100 was converted into two single registered shares with a par value of CHF 50. Unlisted A and B registered shares, with a par value of CHF 50 each, has been replaced by the new single registered shares.The shares were converted on 2 February 2017, which is the first day on which the single registered shares were traded on the stock exchange. Zürcher Kantonalbank is responsible for conversion of the shares.

After conversion, Banque Cantonale de Genève's share capital, totalling an unchanged CHF 360,000,000, consisted of 7,200,000 registered shares, each with a par value of CHF 50.

Action to be taken by shareholders

For holders of bearer shares or A or B registered shares who keep their shares in a securities custody account opened at a Bank, conversion into new single registered shares has been done automatically. On the other hand, holders of bearer shares who keep their shares at home or in a safe deposit must immediately forward these shares to their bank so that they can be converted into the new single registered shares. Furthermore, shareholders who own or subsequently acquire registered shares in the form of intermediated securities of another company, which are held in a BCGE securities custody account, are automatically entered in that other company's Register of Shareholders.Registration in the Register of Shareholders in advance in order to attend general meetings

The Swiss Code of Obligations stipulates a special regime for registered shares: only those shareholders whose names are registered in the company's Register of Shareholders are authorised to exercise their voting rights and related share rights. If the shareholder's name is not registered, personal membership rights are suspended, and the shareholder is not allowed to attend the company's general meetings.To be authorised to attend the Bank's general meetings, shareholders must apply for their names to be registered in the Bank's Register of Shareholders. To register, shareholders must use the application form made available by the Bank.

Geneva, 22 May 2024 – Banque Cantonale de Genève (BCGE) has issued a social bond in the amount of CHF 100 million, with a fixed coupon of 1.60%, to mature on 10.06.2030. The operation has been highly successful with investors.

Very favourable bond issuance conditions

The Bank has successfully placed a new bond on the Swiss market. This social bond complies with the principles of the International Capital Market Association (ICMA) and will facilitate the Bank’s long-term refinancing and ability to financially support public interest projects in the Canton of Geneva.

The quick and successful placement of this issue reflects the high level of investor confidence in the Bank, as well as its excellent reputation as an issuer. BCGE is rated AA-/A-1+/Stable by Standard & Poor’s.