Record Earnings

Half-year Group results as at 30 June 2023

Ad hoc announcements pursuant to Art. 53 LR

Key consolidated figures for the first half of 2023

Sharp rise in business turnover

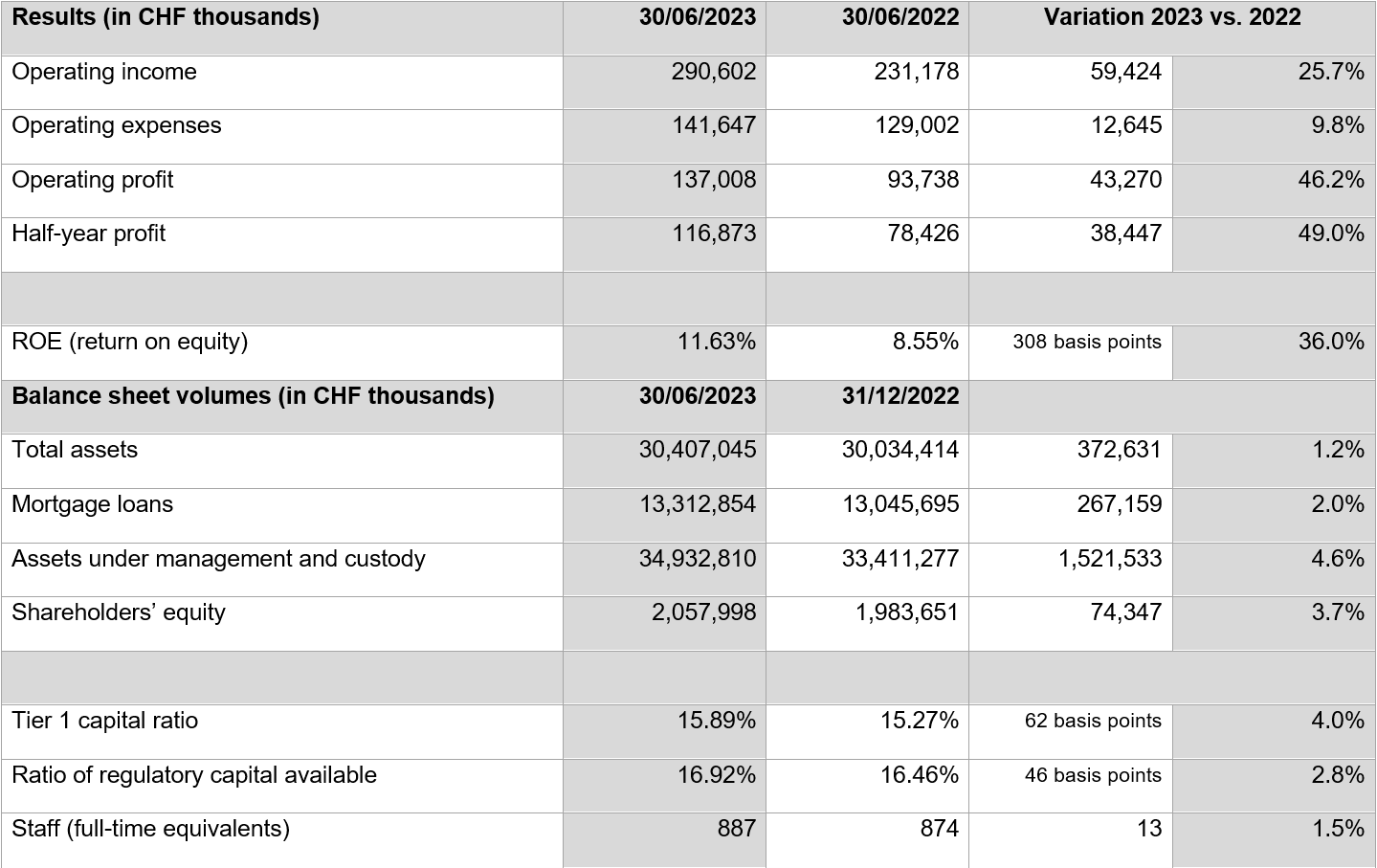

Because of its strategic positioning, the Bank was able to capture the dynamism of the Geneva economy, both domestically and internationally. Assets under management and administration rose 4.6% to CHF 34.9 billion, and client and mortgage loans rose a total of 1.5% to CHF 18.8 billion. Net profit reached a record level of CHF 116.9 million, up 49.0%.

The Bank recorded a marked increase in revenues, with turnover rising 25.7% to total CHF 290.6 million. The Bank adapted well to the change in interest rates, as can be seen from its net interest income of CHF 187.0 million. Sources of revenue remain well diversified, with commissions at CHF 67.3 million and trading operations at CHF 17.8 million. The proportion of turnover in EUR and USD reached 25%, reflecting the international focus of the BCGE Group’s activities. Operating expenses of CHF 141.6 million reflect the Bank's investment in new skills and technologies to support future growth. The Group's workforce grew by 13 new positions and now totals 887 employees (full-time equivalents).

BCGE: helping to finance Geneva's economy

The Bank granted CHF 18.8 billion in loans to companies and individuals. A total of 21,809 companies have placed their trust in BCGE, an increase of 452 companies since the beginning of the year under review. Mortgages increased by 2%. The share of mortgage loans in the balance sheet equalled 44%, reflecting a policy of disciplined asset diversification.

Growth in assets under management and administration

Private client assets increased by CHF 904 million (4.8%) to CHF 19.7 billion. Institutional clients grew by 4.2%, passing the CHF 15 billion mark. New discretionary mandates contributed CHF 112 million to the balance sheet and Synchrony’s 41 funds totalled CHF 3.8 billion. The 1816 online trading platform welcomed its 12,000th investor.

Continued increase in shareholders’ equity

Shareholders' equity rose by CHF 74 million in the first half, crossing a symbolic threshold to reach CHF 2.058 billion. The consolidated equity capitalisation ratio increased further to 16.9%, well above the required standard of 12.7%. BCGE is among the ranks of the most well capitalised and secure banks, as reflected in its AA-/A-1+/Stable rating (confirmed by S&P in July 2023).

A stable shareholder base

The number of private and institutional shareholders remains stable with 15,425 shareholders at 30 June 2023, including 15,004 private shareholders. The free float is widely distributed, with 83% of shareholders holding between 1 and 50 shares.

BCGE share performance: +20.9%

The BCGE share price continued its steep ascent during the first half of 2023, ending the period at CHF 217.0. This increase reduces the gap between the value of shareholders' equity and that of the market capitalisation, even if the potential for appreciation remains significant, with the market value representing 76% of the book value (CHF 285.8).

Strategic priorities for 2023

BCGE's strategic priorities include being a:

- Core partner for the regional economy and SMEs

- Key player in the financing of private and social housing in Geneva

- Private banking specialist for the Swiss and international economies

- Expert in asset management and investment funds

- Important pillar of influence in Geneva's economy, Swiss trade, and around the world

- Promoter of banking digitalisation, accessible to all and with a human touch

- Source of support for business and private clients looking to optimise their energy consumption

Outlook for 2023

The Bank continues to expand and capture the dynamism of growth sectors. It is able to do so thanks to the diversity of its skills and the alignment of its business model with the specific demands of the Geneva and Swiss economies.

- The growth of high added-value business and the loyalty of its client base reaffirm the BCGE’s favourable strategic positioning.

- The Bank’s financial strength makes it a safe and stable financial guardian.

- The Bank expects interest rates to increase moderately and the economic situation to improve, factors which are likely to weigh on its interest margin but boost its commission income.

- The increase in lending will remain moderate due to the regulations governing capital requirements and a policy of caution, particularly in real estate financing.

- The Bank continues to develop its less capital-intensive businesses (private and institutional asset management, corporate advisory services) and offers a broader range of corporate services (equity financing and M&A).