2022 Annual Results

Record profit and dividend

Ad hoc announcements pursuant to Art. 53 LR

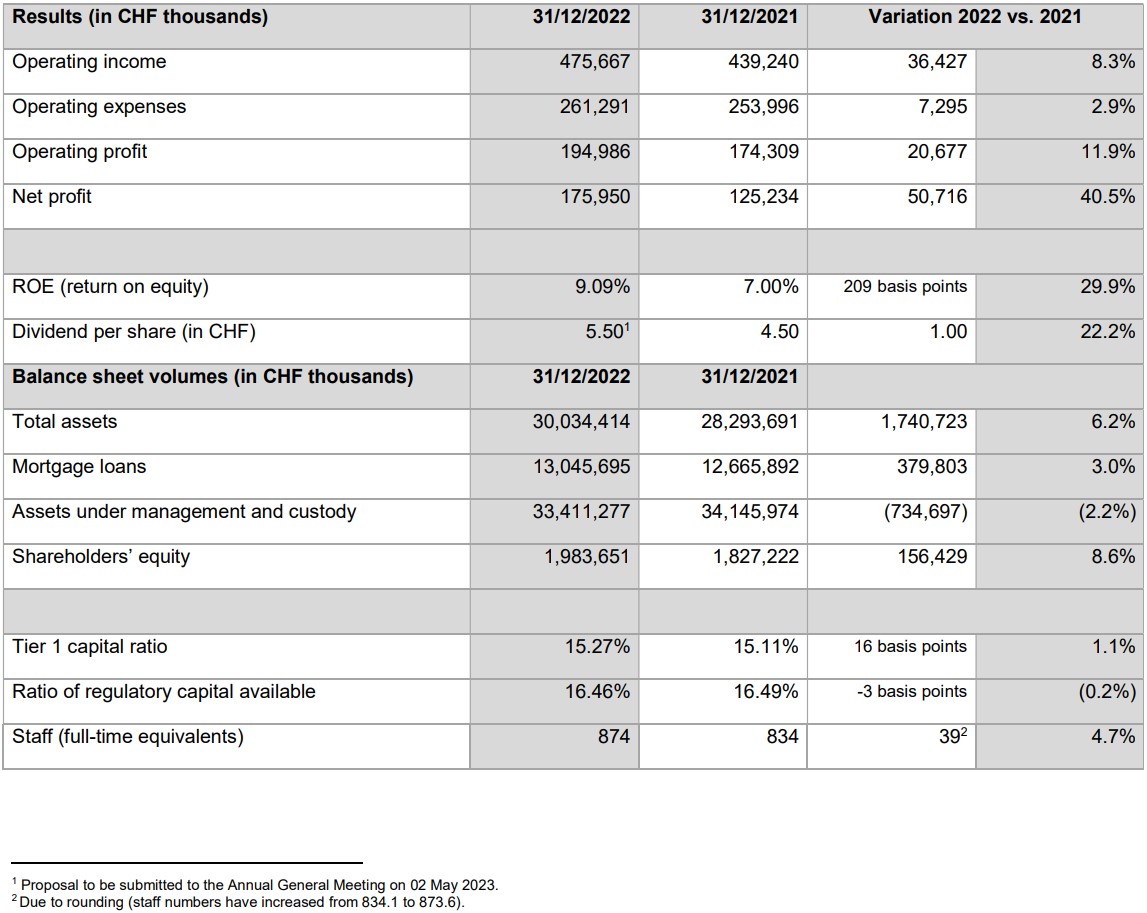

Main consolidated figures for the 2022 financial year

Sharp rise in business turnover

BCGE recorded an excellent performance in 2022 with a 40.5% increase in net profit, totaling CHF 176.0 million (including extraordinary gains of CHF 34.6 million) and an operating profit of CHF 195 million (+11.9%). Increased business volumes reflect the Bank's good strategic positioning, capturing the dynamism of the most buoyant economic sectors. Assets under management and administration rose to CHF 33.4 billion, while client and mortgage loans totalled CHF 18.5 billion. Revenue growth was driven by the interest margin; the Bank successfully navigated the change in interest rates and minimised the effects of the stock market on its commissions, most clients remaining invested. Total turnover amounted to CHF 475.7 million (+8.3%). Net interest income reached CHF 286 million, while commissions totalled CHF 133 million and trading income CHF 38 million. The proportion of turnover in EUR and USD hit 29.7%, reflecting the success of the Bank's international business focus. To benefit private, corporate, and institutional clients, the Bank invested in new skills and technologies, bringing its operating expenses to CHF 261.3 million. The Group's workforce grew by 39 new positions and now totals 874 employees (full-time equivalents).

BCGE: helping to finance Geneva's economy

The Bank granted CHF 18.5 billion in loans to companies and individuals. 21,357 companies have their accounts with BCGE, an increase of 595 companies in the past year. The moderate share of mortgages in the bank's balance sheet total (43%) is evidence of its highly diversified business model.

Resilience in asset management and administration

Private client assets increased by CHF 475 million to CHF 18.8 billion (+2.6%). The net inflow into new discretionary mandates was CHF 231 million. Synchrony's range of 41 funds totalled 3.5 billion. The online trading platform 1816 passed the 11,700-investor mark. Institutional client assets reflected market performance, falling to CHF 14.6 billion (-7.6%).

Continued increase in shareholders’ equity

Equity continued to grow, increasing by CHF 156 million to a total of CHF 1.984 billion. The consolidated equity coverage ratio remained strong, reaching 16.5%, well above the required standard of 12.7%. BCGE is one of a few well-capitalised and secure banks, as demonstrated by its Standard & Poor's AA-/A-1+/Stable rating.

More than 15,500 shareholders

The number of private and institutional shareholders rose in 2022. An increase of 83 shareholders brought the total number of shareholders to 15,506, of which 15,107 private shareholders. This is good news since floating capital is widely distributed; 83% of shareholders hold between 1 and 50 shares. It is also worth noting that 75% of the Bank's employees are shareholders and hold 3.0% of capital.

BCGE share performance: +11.8%

BCGE share price rose strongly in 2022 and ended the period at CHF 179.50. Share market value is 64% of its book value (CHF 278.70) At CHF 1.292 billion of market capitalisation, the potential for appreciation remains significant (equity of CHF 1.984 billion).

Strategic priorities For 2023, our strategic priorities are to be a(n):

- Core partner for the regional economy and SMEs.

- Key player in the financing of private and social housing in Geneva.

- Private banking specialist for the Swiss and international economy.

- Expert in asset management and investment funds.

- Beacon for the influence of Geneva's economy and trade in Switzerland and around the world.

- Promoter of a banking digitalisation that is accessible to all and connects clients with Bank employees.

- Partner with corporate and private clients in the energy transition process.

Outlook for 2023

The Bank continues to expand commercially and capture the dynamism of growth sectors. The Bank's bulwark is its diversified range of expertise and the ability of its business model to line up with the specific demands of the Geneva and Swiss economies.

- The growth of high value-added business and the loyalty of its client base reaffirm BCGE’s favourable strategic positioning.

- The Bank's financial strength makes it a safe and stable financial guardian.

- The Bank expects interest rates to increase moderately and the economic situation to improve, factors which are likely to weigh on its interest margin but boost its commission income.

- The increase in lending will remain moderate due to the regulations governing capital requirements and a policy of caution, particularly in real estate financing.

- The Bank continues to develop its less capital-intensive businesses (private and institutional asset management, corporate advisory services) and will expand its corporate offer (equity financing and M&A).