Application BCGE Twint

L'application BCGE Twint vous permet d'envoyer, de demander et de recevoir de l'argent rapidement et facilement directement de votre compte BCGE, depuis votre téléphone. BCGE Twint vous permet également de payer dans les commerces participants.

L'application BCGE Twint est compatible avec les appareils mobiles suivants

| Système d'exploitation | Fabricant / Appareil |

|---|---|

|

Apple iOS 12.2 (ou supérieur)

|

Apple iPhone (à partir de l’iPhone 5s)

|

|

Android 7 (ou supérieur)

|

HTC, Samsung, LG, Sony Xperia etc...

|

Conditions nécessaires pour pouvoir utiliser BCGE Twint

- Avoir un accès BCGE Netbanking

- Avoir un smartphone ou tablette avec un numéro de téléphone CH

- Avoir un compte BCGE Privé

Activez BCGE Twint

- Pour vous guider lors de votre première connexion, retrouvez ici notre support d'enregistrement

- Pour récupérer votre accès à BCGE Twint, retrouvez ici notre support de réenregistrement

Utilisation de l'application

1. Régler vos achats simplement avec votre smartphone

- Activez Bluetooth et ouvrez l'app BCGE Twint

- Sélectionnez «Payer au Beacon» dans le menu

- Tenez votre smartphone face au Beacon (logo lumineux de Twint)

- C'est payé

Vous pouvez aussi payer avec BCGE Twint aux caisses sans Beacon

- Ouvrez l'app BCGE Twint

- Sélectionnez «Payer avec le code» dans le menu

- Orientez l'appareil photo de votre smartphone vers le code QR affiché

- C'est payé

2. Payer dans les commerces en ligne

Plus besoin de saisir votre numéro de carte bancaire pour chaque paiement en ligne. Avec BCGE Twint, vous pouvez payer rapidement avec votre smartphone.

- Ouvrez l'app BCGE Twint

- Scannez le QR code à l'écran

- Confirmez le paiement

- C'est payé

3. Payer à certains distributeurs de boissons

- Ouvrez l'app BCGE Twint

- Orientez l'appareil photo de votre smartphone vers le code QR affiché sur l'écran du distributeur

- Sélectionnez le produit désiré sur le distributeur

- C'est payé

Certains distributeurs sont également équipés d'un Beacon Twint: maintenez votre smartphone un bref instant face au logo Twint lumineux ou suivez les instructions sur le distributeur.

L'application BCGE Twint vous permet d'envoyer ou de recevoir de l'argent en toute simplicité et en toute sécurité.

BCGE Twint est dans bien des cas la solution la plus pratique pour:

- déposer l'argent de poche sur le compte de vos enfants

- envoyer de l'argent à votre soeur pour le cadeau de votre grand-mère

- recevoir l'argent que vous avez avancé le week-end dernier

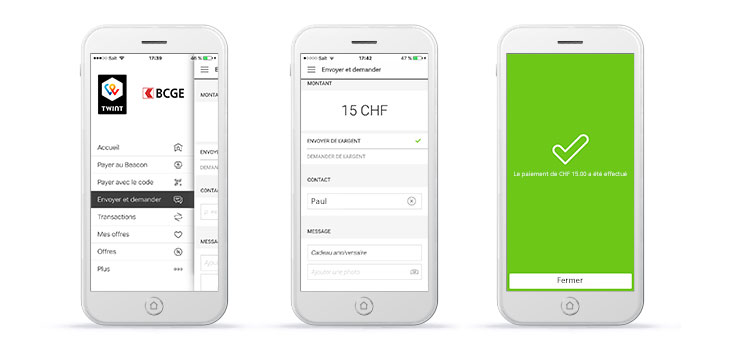

Envoyer de l'argent

- Connectez-vous à BCGE Twint

- Cliquez sur «Envoyer»

- Entrez la somme que vous souhaitez envoyer

- Choisissez le destinataire dans vos contacts.

- Vous pouvez aussi joindre une image et un message

- Appuyez sur «Envoyer» pour confirmer

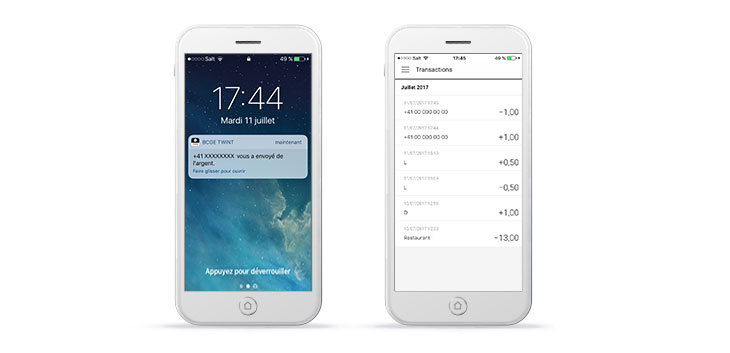

Recevoir de l'argent

- Recevez une notification sur votre smartphone: «+417XXXXXXX vous a envoyé de l'argent.»

- Dans «Transactions», visualisez l'historique des sommes envoyées ou reçues

- Cliquez pour obtenir le détail du paiement

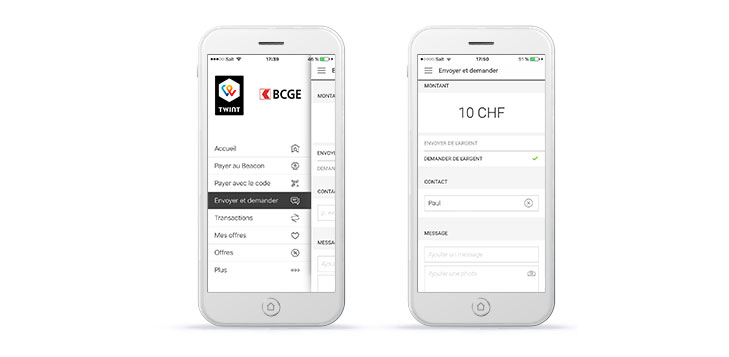

L'application BCGE Twint vous permet de demander directement de l'argent à un ou plusieurs de vos contacts.

- Connectez-vous à BCGE Twint

- Cliquez sur «Demander»

- Entrez la somme que vous souhaitez réclamer

- Choisissez le destinataire dans vos contacts.

- Vous pouvez aussi joindre une image et un message

- Appuyez sur «Demander» pour confirmer

Avec l'application BCGE Twint, offrez un moyen de paiement moderne et rapide à vos clients.

Afin de répondre aux besoins de chaque commerçant, BCGE Twint propose différentes solutions d'encaissement sans espèces.

1. Caisse avec terminal de paiement

Lors de l'encaissement, les clients voient s'afficher un code QR qu'ils peuvent scanner avec leur smartphone. Cette solution est également disponible pour les terminaux mobiles.

2. Caisse avec beacon

L'appareil effectue une connexion entre votre caisse et le smartphone du client. Cette solution est accessible hors-ligne - l'encaissement avec Beacon fonctionne donc même si vos clients n'ont pas de couverture de réseau mobile.

3. E-commerce

Avec BCGE Twint, vos clients paient rapidement et facilement dans votre boutique en ligne. Lors du paiement, un code QR est affiché qui doit être scanné pour effectuer le paiement.

BCGE Twint présente de nombreux avantages, tant pour les commerçants que pour la clientèle. En effet, les clients peuvent payer avec leur smartphone sans qu'une infrastructure supplémentaire ne soit nécessaire. Pour le commerçant, la procédure à suivre au terminal de paiement est exactement la même que pour un paiement par carte. Cela représente moins d'argent liquide à manipuler et une plus grande sécurité pour l'entreprise et ses employés.

Plus d'informations sur le site de TWINT.

Foire aux questions

BCGE Twint est une application de transfert d'argent d'un utilisateur Twint à un autre. Vous pouvez également payer directement sur internet ou dans les commerces participants. Twint est une solution déjà proposée par plusieurs établissements, l'envoi et la réception entre les diverses applications Twint est possible.

BCGE Twint simplifie le transfert d'argent en tout temps, le transfert est instantané et simple.

Oui, l'application et son utilisation n'entraînent pas de frais

Il vous est possible de payer dans les commerces qui possèdent un beacon sans connexion internet. Cependant, le Bluetooth est dans ce cas nécessaire. Les autres fonctionnalités ne sont pas disponibles sans réseau internet.

Afin de vous enregistrer à Twint et connecter votre compte BCGE, il faut télécharger l'application BCGE Twint et suivre les étapes d'enregistrement. Il vous faut également un accès à BCGE Netbanking et un compte BCGE Privé.

Vous pouvez être enregistré sur plusieurs applications Twint mais il est uniquement possible d'utiliser l'application à laquelle vous vous êtes enregistré en dernier.

Afin d'activer votre compte BCGE Twint, vous recevrez une lettre dans les jours qui suivent votre enregistrement. Il vous faudra alors scanner le QR code sur cette lettre pour finaliser l'activation de votre compte BCGE Twint dans les 5 jours suivant l'enregistrement.

L'activation de votre compte BCGE Twint vous permet d'utiliser l'application avec des limites de paiement plus élevées. Si vous n'activez pas votre compte dans les 5 jours suivant votre enregistrement, vous ne pourrez plus utiliser les fonctions de paiement, d'envoi et de demande d'argent.

Dois-je obligatoirement avoir un numéro de contrat BCGE Netbanking pour m'enregistrer à BCGE Twint ?

Oui, afin de vous enregistrer et pour des raisons de sécurité vous devez rentrer votre numéro de contrat Netbanking dans l'application.

Vous pouvez utiliser BCGE Twint à partir d'un compte BCGE Privé 12-25 ou BCGE Privé.

Après enregistrement de votre compte sur l'application, vous ne pouvez pas envoyer plus de CHF 50 par jour et au total CHF 200. Vous avez ensuite 5 jours pour finaliser l'enregistrement de votre compte BCGE Twint grâce à la lettre reçue chez vous ou dans les E-documents de votre Espace client. La limite mensuelle est alors étendue à CHF 4'000 pour les paiements entre deux personnes et à CHF 5'000 pour les paiements dans les commerces.

Si vous avez oublié votre code PIN, veuillez prendre contact avec le banque en ligne au 058 211 21 00 (du lundi au vendredi de 7h30 à 19h30, le samedi de 9h00 à 16h00 et le dimanche de 3h00 à 13h00).

En cas de vol ou de perte de votre smartphone, veuillez appeler la banque en ligne afin de faire bloquer votre compte Twint. Il ne devrait cependant pas être possible de l'utiliser sans connaître le code PIN préalablement défini par vos soins.

Si vous changez de téléphone, veuillez télécharger l'application une nouvelle fois et informer la banque si votre numéro a changé. Sur demande, l'accès lié à votre ancien numéro peut être fermé. Vous pouvez prendre contact avec la banque en ligne au 058 211 21 00 (du lundi au vendredi de 7h30 à 19h30, le samedi de 9h00 à 16h00 et le dimanche de 3h00 à 13h00).

Les conditions d'utilisation de BCGE Twint sont disponibles sur le site https://www.bcge.ch/twint-utilisation, sur l'Apple Store et sur Google Play, ainsi que dans l'application BCGE Twint lors de la phase d'enregistrement.