2021 Annual Results

Record net profit and dividend

Ad hoc announcements pursuant to Art. 53 LR

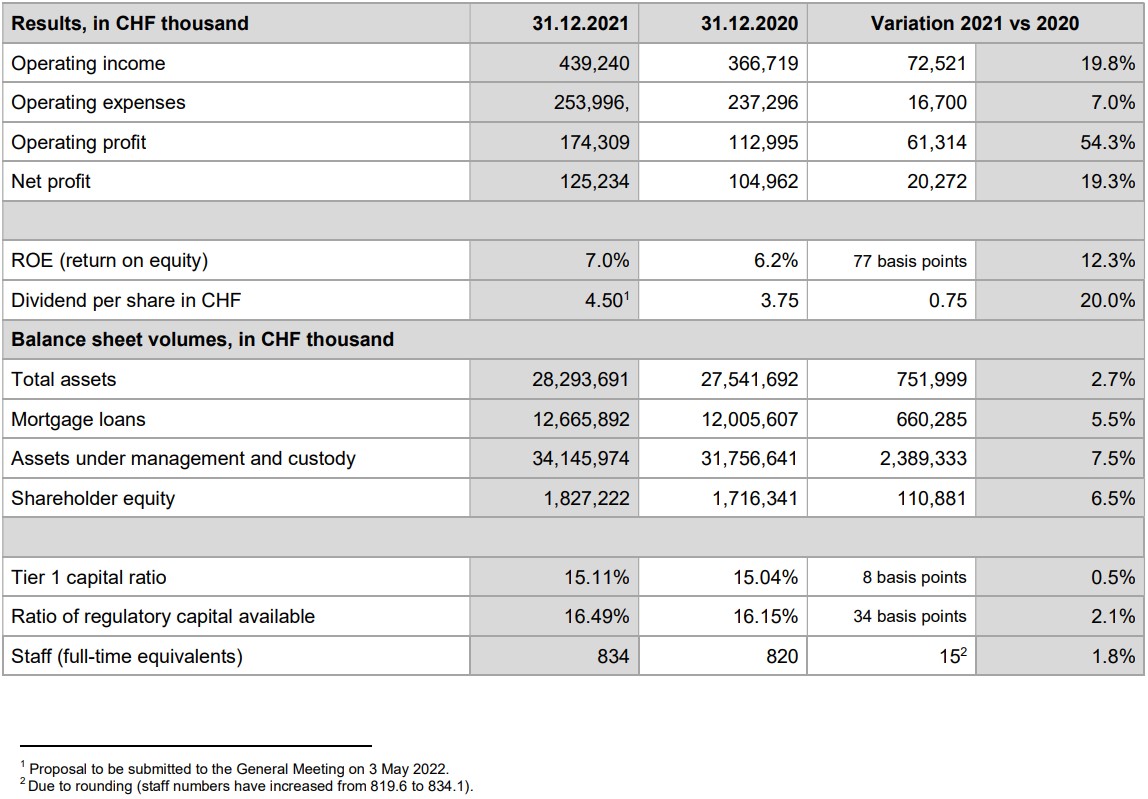

Key consolidated figures for the financial year 2021

All performance indicators are up

The bank's excellent economic performance demonstrates its ability to capture the economic recovery. Business turnover rose sharply to CHF 439 million and net profit increased to CHF 125.2 million. Operating expenses of CHF 254 million reflect the investment dynamic. The bank's productivity is on a par with the best Swiss universal banks with international activities, with a cost income ratio of 57.8%. The bank created 15 new specialised jobs in 2021 and the number of employees now stands at 834 employees (full-time equivalents).

Net interest income reflects the growth in corporate and retail loans to CHF 228 million (+5.7%). Commissions rose to CHF 136 million (+17.7%) thanks to private banking with its network of branches in Geneva and Switzerland, and to international trade finance. The share of revenues in EUR and USD accounted for 27.5% of turnover, reflecting a healthy diversification of the business portfolio and the geographical scope of activities.

A major contributor to financing Geneva's economy

The bank grants a total of CHF 18.4 billion in loans to companies and individuals, up by CHF 763 million in 2021. Mortgage loans reached CHF 12.7 billion and represent 45% of the balance sheet total, a proportion that reflects the efficient diversification of the bank's balance sheet. Loans to companies and public authorities increased by CHF 102 million (to CHF 5.7 billion). The bank now has 20,762 companies among its clients, an increase of 153 since 31 December 2020.

Assets under management and custody crossed the threshold of CHF 34 billion

The bank continues to be highly competitive in asset management. Assets under management and custody showed record growth, up CHF 2.4 billion (+7.5%). This is due in particular to the influx of funds from private clients. Private banking grew strongly with more than 1,222 new management mandates from the Best of range. Investment funds rose by 21.7% to CHF 3.9 billion, reflecting the growing success of the Synchrony brand.

Continued increase in shareholder equity

Shareholder equity increased by CHF 111 million (+6.5%) to over CHF 1.8 billion. This figure is the result of a constant increase which, since 2005, has seen the creation of more than CHF 1.1 billion of additional shareholder equity. BCGE belongs to the circle of well-capitalised and sound banks, as reflected by the upgrade of its rating by Standard & Poor's to AA-/A-1+/Stable on 4 November 2021.

355 new shareholders

The number of private and institutional shareholders of the bank is increasing every year. The shareholder community grew by 355 persons or entities. The bank thus registered 15,423 shareholders as at 31 December 2021, including 15,051 private shareholders. The shareholder base is well diversified (83% of shareholders known to the bank hold between one and fifty shares). 77% of employees are shareholders, holding 2.6% of the bank’s capital.

The share price is gradually approaching its intrinsic value

The share price was stable in 2021, with a slight increase in the market capitalisation to CHF 1.156 billion and an equity value of CHF 1.827 billion. With a book value of CHF 257.6 and given the excellent results, the share has substantial upside potential.

The proposed dividend is significantly higher

The dividend submitted to the General Meeting for approval is CHF 4.50 or 9% of the nominal value which represents an increase of 20%. The bank’s contribution to public authorities, mainly the State and Geneva municipalities, in the form of taxes and dividends, totals CHF 61 million for the 2021 financial year.

Strategic priorities for 2022

The bank is currently working on seven strategic priorities, summarised as follows:

- Core partner for the regional economy and SMEs

- Key player in the financing of private and social housing in Geneva

- Recognised experience in advisory services for Swiss and international private banking

- Expert in asset management and investment funds

- An important pillar for influence of Geneva's economy and trade in Switzerland and around the world

- Innovative leader in digital banking

- Partner to corporate and private clients in the energy transition process

Outlook for 2022

The bank is continuing its commercial expansion by capturing the economic recovery. It relies on the diversity of its skills and on the alignment of its business model with the specific demands of the Geneva and Swiss economy.

- The growth of high added-value business and the loyalty of its client base confirm the BCGE’s favourable strategic orientation

- The bank's financial strength makes it a safe and stable custodial address.

- The bank expects interest rates to remain low and the economic situation to improve, factors which are likely to weigh on its interest margin but which will boost its commission income.

- The increase in loans will remain moderate due to the regulations governing capital requirements and a policy of caution, particularly in real estate financing.

- The bank is stepping up the development of its less capital-intensive businesses (private and institutional asset management, corporate advisory services) and is expanding its corporate offer (private equity and M&A).

Barring a deterioration in the economic situation and taking into account the projected commercial developments, the bank expects a slight increase in the overall earnings for the year.