Fixed rate mortgage

A fixed mortgage allows you to acquire a property at the same rate for the duration of the loan. It ensures the stability of your loan and protects you from the possible rise in market rates.

Realise your acquisition project with quality support

An interest rate and a loan period which are determined up-front

Stable interest charges, enabling you to plan your budget with peace of mind

An interest bonus on your savings thanks to the Avantage service loyalty programme

The essentials

Quality support throughout your project

Are you planning to build, buy or renovate a property? You are already a homeowner and are looking for the financing options best suited to your situation? We offer you simple, advantageous mortgage solutions that can be adapted to your needs.

The acquisition of a property requires competent advice, quality support and in-depth dialogue with a specialist. Talk to your adviser.

Become a homeowner with complete peace of mind

The mortgage loan for a residential property finances up to 80% (in the case of a new acquisition) of the value of the object.

Discover a stable property loan

A fixed rate is advantageous if the general level of interest rates is low or if you fear that there might be a general rise in market rates. A fixed rate mortgage provides you with stability for your property budget by protecting you against market rate rises.

A loan for all projects

In the case of a renewal or a mortgage being taken on from the competition, the BCGE lends up to 80% of the value of the property (calculated on the value of the collateral estimated by the bank). The whole of the mortgage is set up on the basis of one single rate.

Very interesting tax benefits

The interest on the loan can be deducted from your annual income and the capital borrowed can be deducted from your personal wealth.

Avantage service loyalty programme

Each year, your mortgage loan earns you interest bonuses on your BCGE Epargne account thanks to the Avantage service loyalty programme.

Receive a weather station for free

When concluding a mortgage loan with the BCGE, we will offer you a weather station for your future home. Thanks to this high-quality product, weather forecasts will hold no more secrets for you.

Further information

Minimum amount

CHF 100,000

Term of the fixed rate contract

2 to 15 years

Rates

The fixed rate is determined for the duration of the contract. For current rates, please ask your adviser.

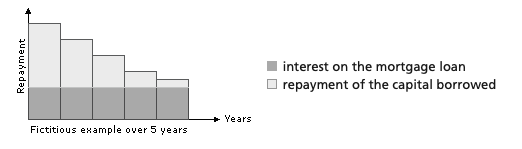

Repayment

The annual charge (annuity) for granting a mortgage loan comprises:

- interest on the mortgage loan (fixed for the duration of the loan)

- repayment of the capital borrowed

Optional services

- Direct or indirect amortisation (Epargne 3 account or mixed life insurance)

- Possibility of including risk cover (death/disability) with Swisscanto Safe insurance

You can also consult

Do you need a loan?

Contact us

Run a simulation

Calculate