Responsible performance

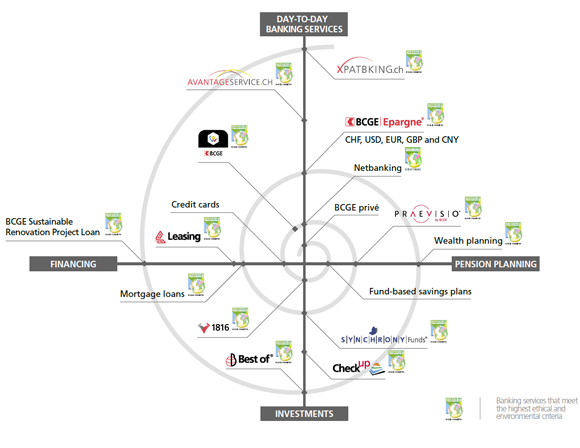

Banking services that meet the highest ethical and environmental criteria.

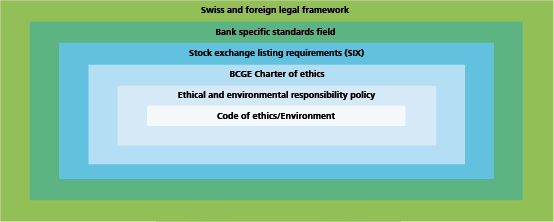

Guidelines for action

- The bank is both a public and private project that supports the economic development of Geneva and its region.

- The bank creates value for all its stakeholders.

- The bank offers its clients the choice between traditional or "responsible" banking services.

- Responsible performance brochure

- Sustainable finance: the real requirements

Framework for action

BCGE is committed to its stakeholders:

The shareholders

BCGE is committed to its shareholders by motivating them with strong results, a well-balanced dividend policy and a listing on the capital market which constitutes a guarantee of transparency and imposes a very demanding code of conduct.

The clients

BCGE is committed over the long term to its clients and their family circle by respecting their interests, providing them with high quality advice and transparent communication.

The team

BCGE is committed to its employees with loyalty and respect by supporting their personal development and treating them without discrimination.

The community

BCGE is committed to contributing to the development of the economy by distributing its services in an equitable way, supporting socially responsible activities, creating added value for public authorities and exercising its legal mission of contributing to the development of the economy. In the field of financing and investment, it is careful not to support projects that are contrary to its principles of social responsibility.

A range of strategic banking services for individuals*

Investments

The Best of ESG mandate is built on the same principles as its predecessors and allows clients to benefit from almost 20 years of proven experience starting at CHF 100,000. This new management mandate, which is compatible with the requirements of sustainable finance, is available in CHF in 4 investment profiles, depending on the risk profile of each investor: defensive, balanced, dynamic or world equity. The asset allocation corresponds to that of the Best of classics.

These funds invest for the long term in approximately 30 Swiss secondary securities (listed companies outside the SMI) selected on the basis of sustainable criteria. To be selected, companies must have financial, social and environmental qualities that are both globally balanced and individually above average.

This fund invests in federal bonds for at least two thirds of its value. The balance may be invested in bonds or other debt securities issued or guaranteed by a Swiss public-sector entity or by a central mortgage bond institution.

The 1816 platform allows you to manage your investments independently on the stock exchange. Integrated into Netbanking and BCGE Mobile Netbanking, 1816 is paperless, simple, practical and competitive.

Code of conduct

The internal "Responsible Performance" label is reserved for services that meet a number of selective criteria. Our selection principles are as follows:

-

It is not the technocracy but the investor who decides on his selection criteria for sustainable investments

Choices must be made in the face of the multitude of restrictions and requirements that can be applied to a company. These choices are primarily made by investors and do not have to be taken up by well-meaning private or public think tanks. For example, the carbon-wind-power-nuclear controversy divides many investors. Each investor will articulate his or her vision and it is his or her preferences that will shape the portfolio. It is then up to the manager to look for selection and filtering solutions.

-

ESG filtering must lead to better long-term financial performance

The applications of the ESG approach are very diverse. Therefore, the different issues need to be identified and priorities set, with the main focus on improving the performance of the portfolio.

This often leads to tricky situations in which a decision has to be made. For example, what about impact investing, which is an effective investment that serves a good cause but then leads to a deterioration in the performance of a pension fund? In our opinion, a case like this goes beyond the scope of ESG and approaches philanthropy, which is a completely different approach (gratuitous, anonymous).

In addition, “countless academic studies investigating the relationship between corporate social responsibility and share performance have come to contradictory conclusions on the subject“1. In the absence of scientific evidence, positive or negative, we continue to believe that good corporate governance helps improve a company´s chances of performing well. Corporate governance must therefore be carefully examined by the analyst when assessing the company and its shares.

-

Promote rather than coerce

The most militant ESG investors are rising to the forefront and using a vocabulary that is deliberately combative. They make eloquent speeches at general meetings to exert pressure. Some index fund managers, caught up in their all-inclusive approach, recycle ESG rhetoric and resort to power demonstrations to justify holding certain positions they should be selling according to their own criteria. In reality, shareholder activism has a rather mixed record. In any case, it should remain in the realm of incentive rather than coercion and confrontation.

-

Vote with your feet

An expression attributed to Ronald Mc Donald; the best way to express your financial or ethical dissatisfaction with a listed company is to refrain from buying its shares. Fundamentalist activism, on the other hand, is based on a contradiction: it encourages investors to buy as many shares as possible of a questionable company. The purpose is to bring together as many votes as possible: logical. But in doing so, it exposes the very same investors to the risk of the weak position throughout the duration of the deal and if it fails to implement the desired change, the risk is greater.... Instead, we advise investors to use their feet and be very selective, and leave the investors who are forced by their investment style, such as the index-linked fund, to struggle with problematic companies...

-

Evaluate a company as a whole

Active management consists of a strict selection of equities in a portfolio. Analysts must assess the company as a whole. It makes little sense to look at the financial aspect without looking at the corporate governance or strategy aspects. The expert analyst must make a recommendation to buy, hold or sell the security based on a multitude of criteria and in very different contexts depending on the company. Different filters and scoring models are used, but only as a decision-making aid. Ultimately, they must use their judgement and reputation as an expert.

-

Submit ESG performance to external assessment

Rather than labelling its investment instruments itself, the bank has decided to have them externally assessed in terms of ESG criteria.

This is to avoid any accusation of a lack of objectivity, or even the risk of overly optimistic rhetoric about the supposed environmental effects of an investment approach. The bank has selected a very advanced and comprehensive rating system. It is gradually extending this rating principle to all its investment products, primarily funds and certain mandates. This will provide clients with a tool to monitor and measure “ESG performance“ on a regular basis for the products concerned. This enables a concrete and factual dialogue between investor and adviser in order to align and adjust the portfolio to ESG qualitative objectives.

1 “ESG data: growing popularity and associated risks“ N. Jamet, Senior Analyst, RAM, Agefi, 18.07.18, p16

We invite you to consult bcge.ch, synchronyfunds.ch, avantageservice.ch and in particular to download our online brochures

More than 20 years of commitment and innovation

How to acquire equipment, borrow or invest money, seek advice, obtain information or protect oneself while aiming for the highest ethical and environmental criteria?

Your are a BCGE client:

- Contact your BCGE adviser

- Arrange a meeting online at bcge.ch

You are not yet a BCGE client:

- Contact us on 058 211 21 00 Monday to Friday from 7h30 to 19h30, Saturday from 9am to 4pm and Sunday from 9am to 1pm.

- Write to us using the contact form

- Arrange a meeting online at bcge.ch

- Arrange a meeting online at avantageservice.ch

- Arrange a meeting online at synchronyfunds.ch

Glossary of terms

Sustainable development: Concept of economic growth with a longterm perspective and integrating environmental and social constraints.

ESG – Environmental, Social and Governance:

- Environmental: takes into account all the issues related to the impact of human activities on nature and the generation of environmental risks.

- Social: considers the organisation of social interactions, including factors such as gender, human rights, relations with the civil community.

- Governance: focuses on the alignment of interests between capital providers and business leaders.

SRI: Socially Responsible Investment

CSR: Corporate Social Responsibility