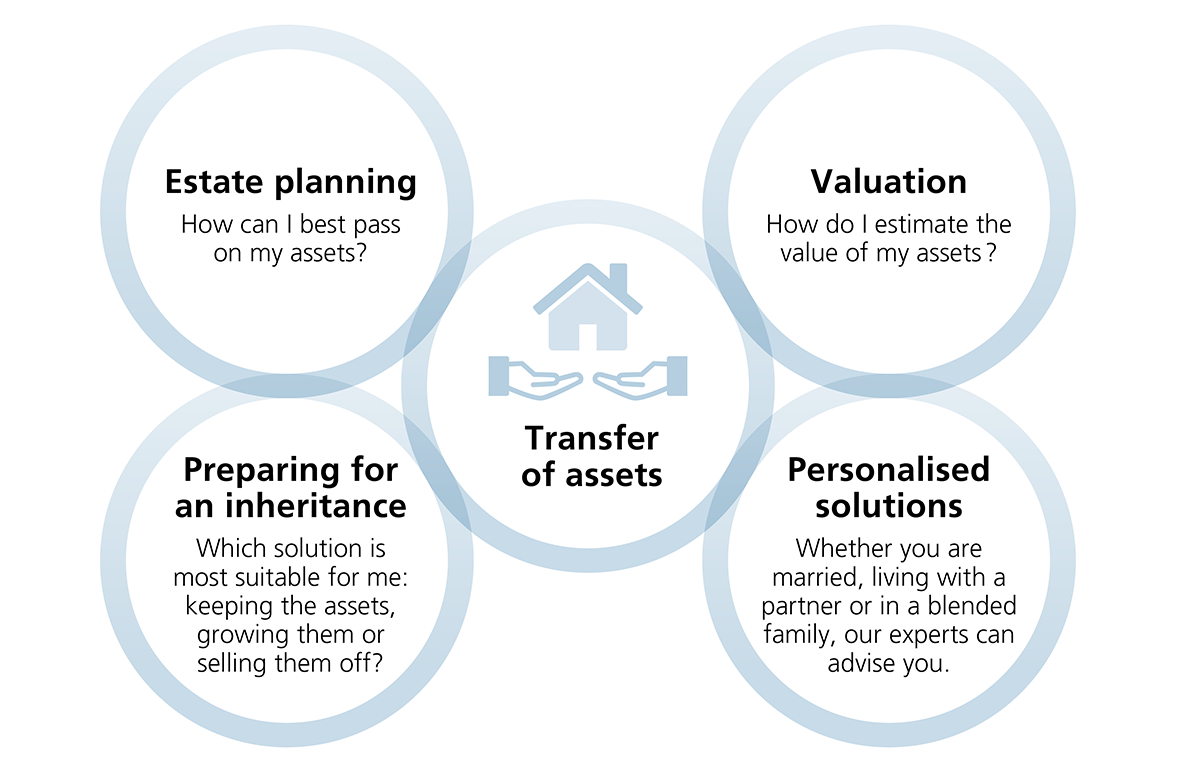

Transfer of assets

Whether you want to pass on your assets to your descendants or are preparing for an inheritance, BCGE is here to help you.

Comprehensive analysis of your current situation

Definition of your expectations and needs

Implementation of a tailor-made solution

Individual support from our experts

News 2023

The revised law of succession has come into force this year. The freely disposable portion, i.e. the part of the estate that can be passed on to a person of your choice, has been increased. Therefore, you should make sure that your will still reflects your wishes under the new rules.

We can provide assistance on the following topics:

The valuation of real estate or collectibles is often complicated. However, these assets are part of the estate and must be distributed to your heirs in accordance with the law and your wishes.

Under the new law, each case is treated differently. Whether a particular marital regime needs to be considered, whether you are living with a partner or in a blended family, or whether you are in the process of getting a divorce, our experts can provide you with an analysis adapted to your specific situation.

The tax heirs have to pay can range from 0 to more than 50%, depending on the degree of kinship, the canton, the country of residence or even the location of the assets that are to be passed on. However, you can take measures to protect the capital beforehand. Our team of experts is at your disposal to discuss this matter.

A frank and transparent discussion with the future heirs is crucial to clarify all matters concerning the succession and the last will.

The transfer of a company to a successor or to an external buyer is a major challenge for any business owner. The planning of the transfer should begin several years before the actual takeover.

Some additional examples:

This document should be carefully drafted and handed over to a person of trust, a lawyer or a notary public in order to establish how the assets are to be distributed among family members and relatives.

Unless action was taken beforehand, the State must look after the interests of a person. In case of loss of judgement, a person or a third party is appointed by the guardianship authority to administer all assets. To prevent a stranger from taking over this task, a close relative or a specific person may be appointed. In order to do this, an advance directive must be drawn up.

An inheritance agreement generally offers more flexibility than a last will. For it to be valid, it must be signed by all legal heirs (that are of age).

A donation is defined as an act by which the ownership of an asset is transferred to another person during the donor’s lifetime without any consideration in return. The act must take into account the compulsory portion.

It is possible to pass on part of your estate to the legal heirs during your lifetime as part of their future inheritance. Parents can bequeath their house to their daughter or their son, for example. However, the beneficiary must “return” the advancement upon the death of the testator, unless otherwise agreed. This is to ensure that all heirs enjoy the same rights.

Tarification

Our experts are at your disposal for any specific questions you may have.

- The first appointment (to gather initial information) is free of charge and without obligation.

- Fees depend on the complexity of the request and can range from CHF 250 to CHF 4,500

- More detailed information can be found in the product sheet below.

Do you need assistance?

Contact us