The end of LIBOR and the introduction of SARON

Following the announcement by the UK Financial Conduct Authority on 27 July 2017 and 5 March 2021, the London lnterbank Offered Rate (LIBOR) in Swiss francs was discontinued at the end of 2021. This decision had an impact on the Swiss market for loans to individuals and companies indexed to the LIBOR. BCGE now offers its clients loans indexed to the Swiss Average Rate Overnight (SARON)

LIBOR is a measure of the average rate at which banks are willing to borrow unsecured funds. It is administered by the ICE Benchmark Administration (IBA) and is calculated as an average of the values provided by selected panel banks. It is calculated in five currencies (USD, GBP, EUR, CHF, JPY) and a range of maturities (ON/SN, 1W, 1M, 2M, 3M, 6M, 12M).

LIBOR is the most widely used interest rate benchmark and serves as a price reference for a broad range of financial instruments, such as loans, bonds, and derivatives.

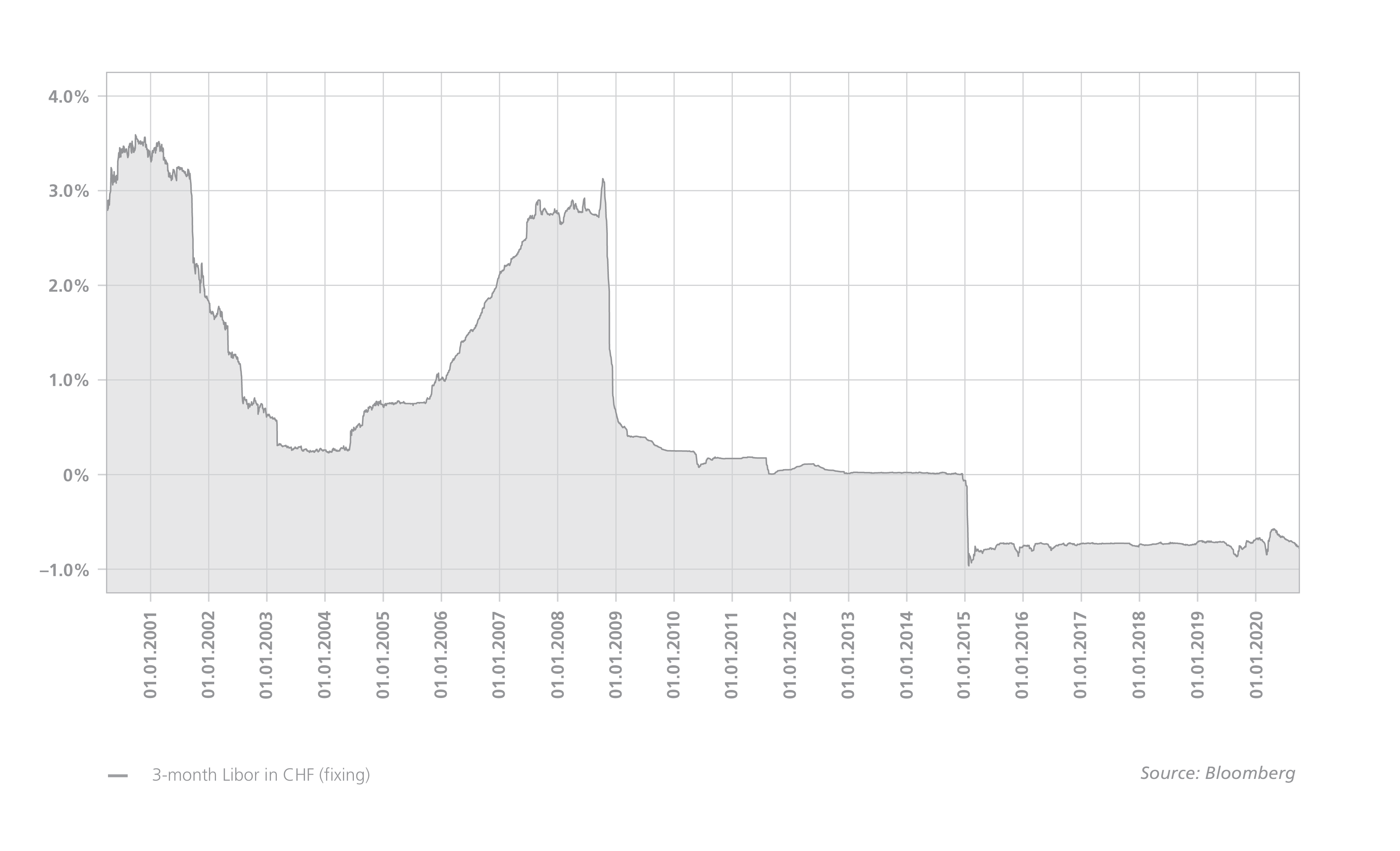

Evolution of 3-month LIBOR in CHF since 1 January 2000

The calculation of the LIBOR in Swiss francs is almost entirely based on expert opinions rather than actual transactions.

The Financial Conduct Authority (FCA), the regulatory authority supervising the LIBOR administrator, announced that the LIBOR interbank rate would no longer be updated for the euro and the Swiss franc, as well as for certain dollar, yen and sterling maturities from 31 December 2021. A switch to an alternative reference rate for the Swiss franc was inevitable.

The National Working Group (NWG) on Swiss reference interest rates is the committee responsible for promoting the transition to an alternative reference rate to Swiss franc LIBOR and for assessing the latest international developments. The presidency the NWG is held jointly by a representative of the private sector and a representative of the Swiss National Bank (SNB). Participation in this working group is open to other important stakeholders and financial market players, including BCGE.

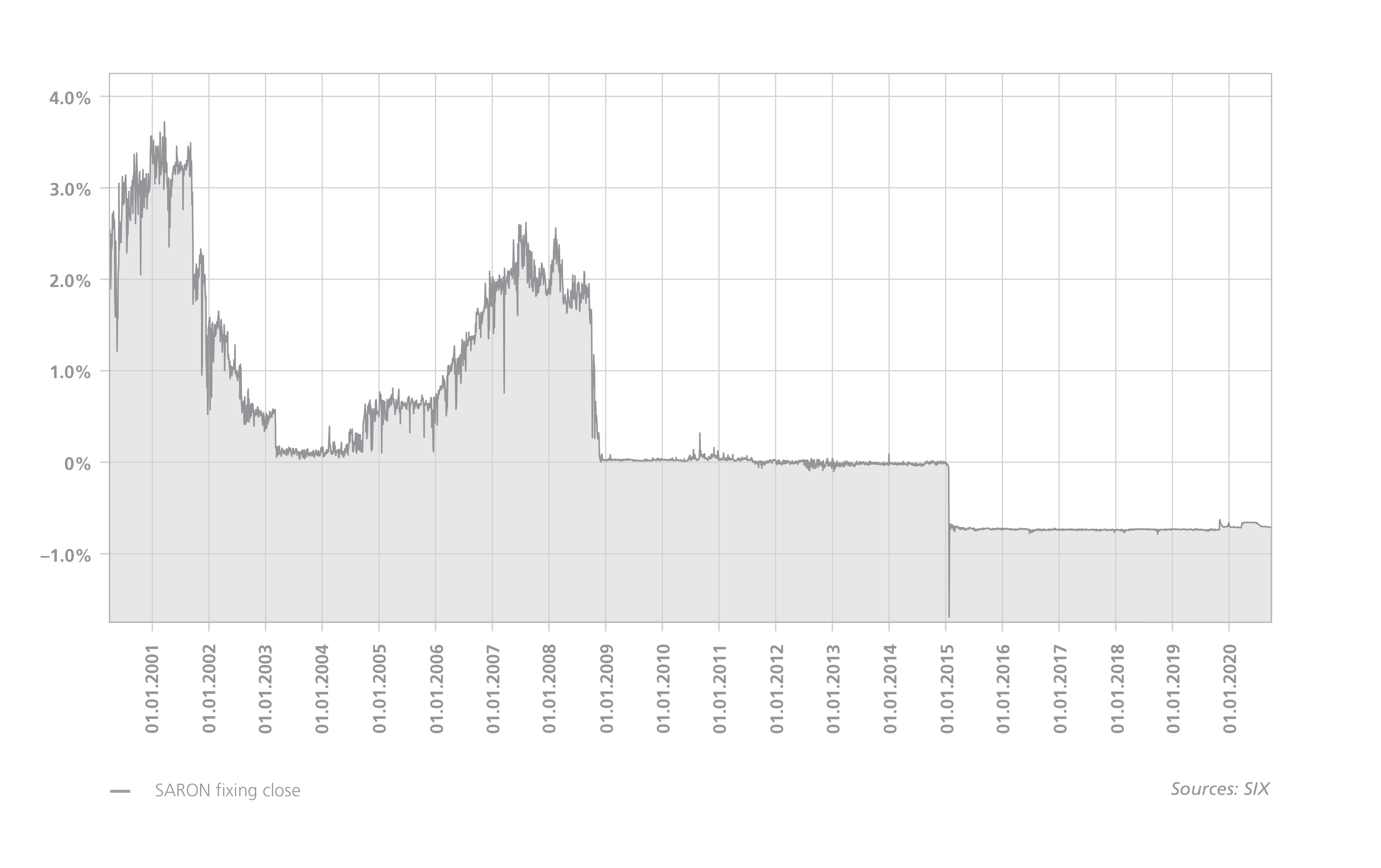

The working group recommended that the SARON (Swiss Average Rate Overnight) be used as a replacement interest rate. The SARON is an overnight interest rate based on data from the secured Swiss franc money market, also known as the "REPO market” for repo transactions (Sale and Repurchase Agreement).

Le Swiss Average Rate Overnight (SARON) reflects the conditions for overnight transactions in the secured Swiss franc money market. The SARON is administered by SIX Swiss Exchange (SIX).

SARON is calculated as a volume-weighted average of transactions and binding quotes in the order book of SIX’s electronic trading platform. The methodology, which was developed in coordination with the Swiss National Bank (SNB), is transparent and publicly available.

SARON is calculated immediately after the market has closed (6 pm) with further fixings during the day at 12 noon and 4 pm. The SARON is based on the 6 pm fixing.

The SARON's fixing mechanism has a clear governance structure that complies with international benchmark standards. At the beginning of 2017, SIX founded the Swiss Reference Rates Index Commission, which periodically reviews all aspects of SARON in CHF.

The main characteristics that make SARON an alternative reference index to LIBOR in Swiss francs are as follows:

- it is representative because it is based on actual transactions

- it is robust because it is based on the REPO market and its methodology is transparent and accessible to the public

- it is administered by SIX which operates the infrastructure for the Swiss financial centre in full compliance with index regulations.

All of these characteristics reinforce the National Working Group's decision to recommend SARON to replace LIBOR in Swiss francs. The historical SARON rates are available on the SIX website.

Evolution of SARON since 1 January 2000

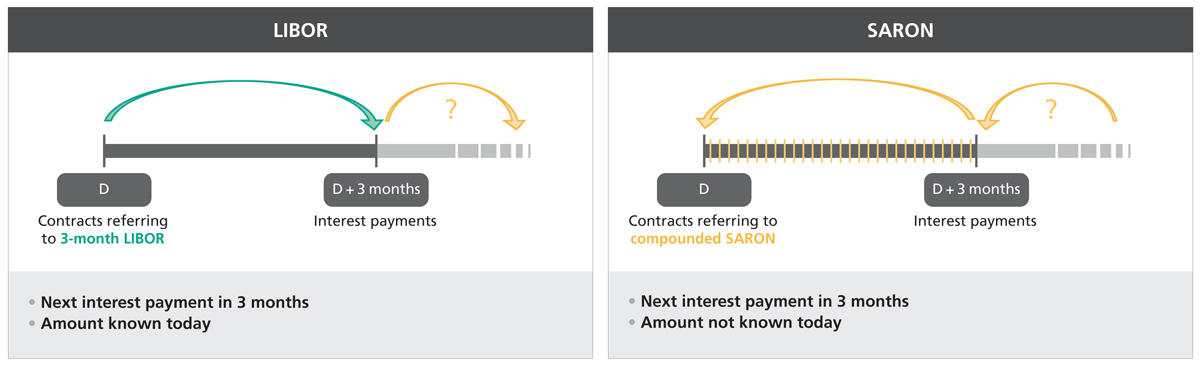

When a forward rate such as the three-month LIBOR is used as a benchmark in a financial contract, the interest payments are already known at the beginning of the calculation period. This type of forward-looking term rate reflects the expected level of interest for the next three months and is equivalent to a sequence of expected overnight rates.

The SARON is a reference interest rate for overnight transactions. Consequently, the SARON cannot be used directly for loans with a term of more than one day. The recommendations of the National Working Group on the Swiss reference is outlined on the website of the SIX administrator.

If the compounded SARON is used as the reference rate for loans, the interest payments are based on the daily compounded interest rates. Whether or not interest payments are known at the beginning of the interest calculation period depends on how a compounded SARON is applied.

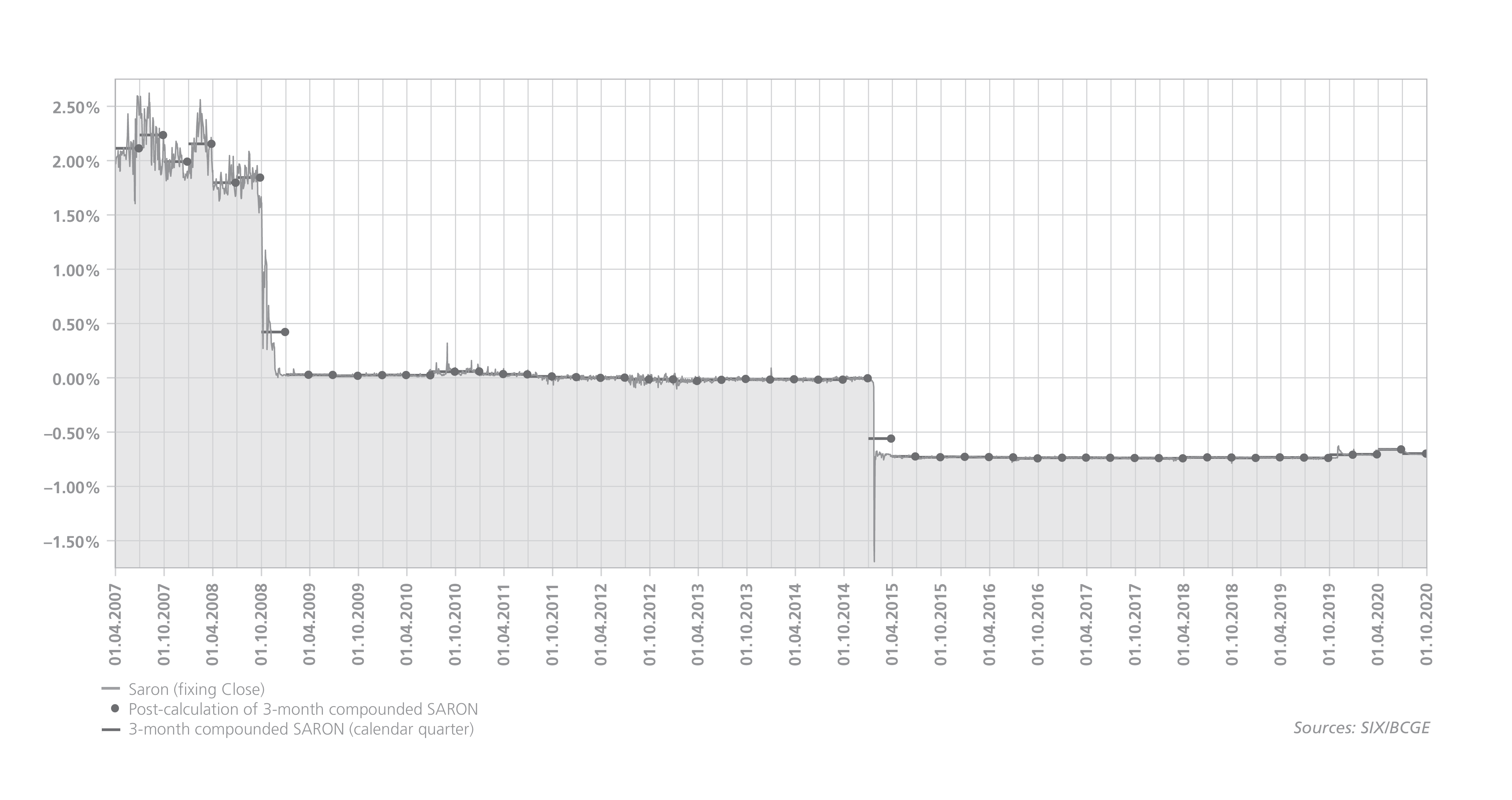

The National Working Group has introduced six variants for applying the compounded SARON in financing. They have been defined in order to respond to the specificities as well as to the constraints of the implementation of financial products and apply the following concepts:

- an "observation period" during which an actual SARON fixing sequence is observed and taken into account for the calculation of the compounded SARON

- an "interest period" during which the loan capital is taken into account for the calculation of interest

The main variants used in financing are generally the so-called "variants":

- "Plain": for which the "observation period" and the "interest period" coincide

- "Lookback": for which the "observation period" is of the same duration as the "interest period" and is anticipated by a few days in order to allow, among other things, for processing interest statements that are invoiced on the end date of the "interest period"

Lookback variant (2 business days)

For mortgage loans indexed to LIBOR in Swiss francs, the compounded SARON is used as a reference for the calculation of interest at BCGE. For BCGE, this approach is consistent with its desire for transparency with its clients, in accordance with the recommendations of the National Working Group.

Clients benefiting from LIBOR-indexed loans in Swiss francs at BCGE will be duly informed of the terms and conditions of the transition from LIBOR in Swiss francs to SARON and will be offered a simple, flexible approach adapted to their specific needs.

Evolution of SARON and compounded SARON in the 2-day Lookback variant

The main Swiss reference rates, including the SARON, can be consulted on the website of the SIX Swiss Exchange administrator. The compounded SARON interest rate can be calculated by means of calculator provided by the SIX Swiss Exchange administrator.

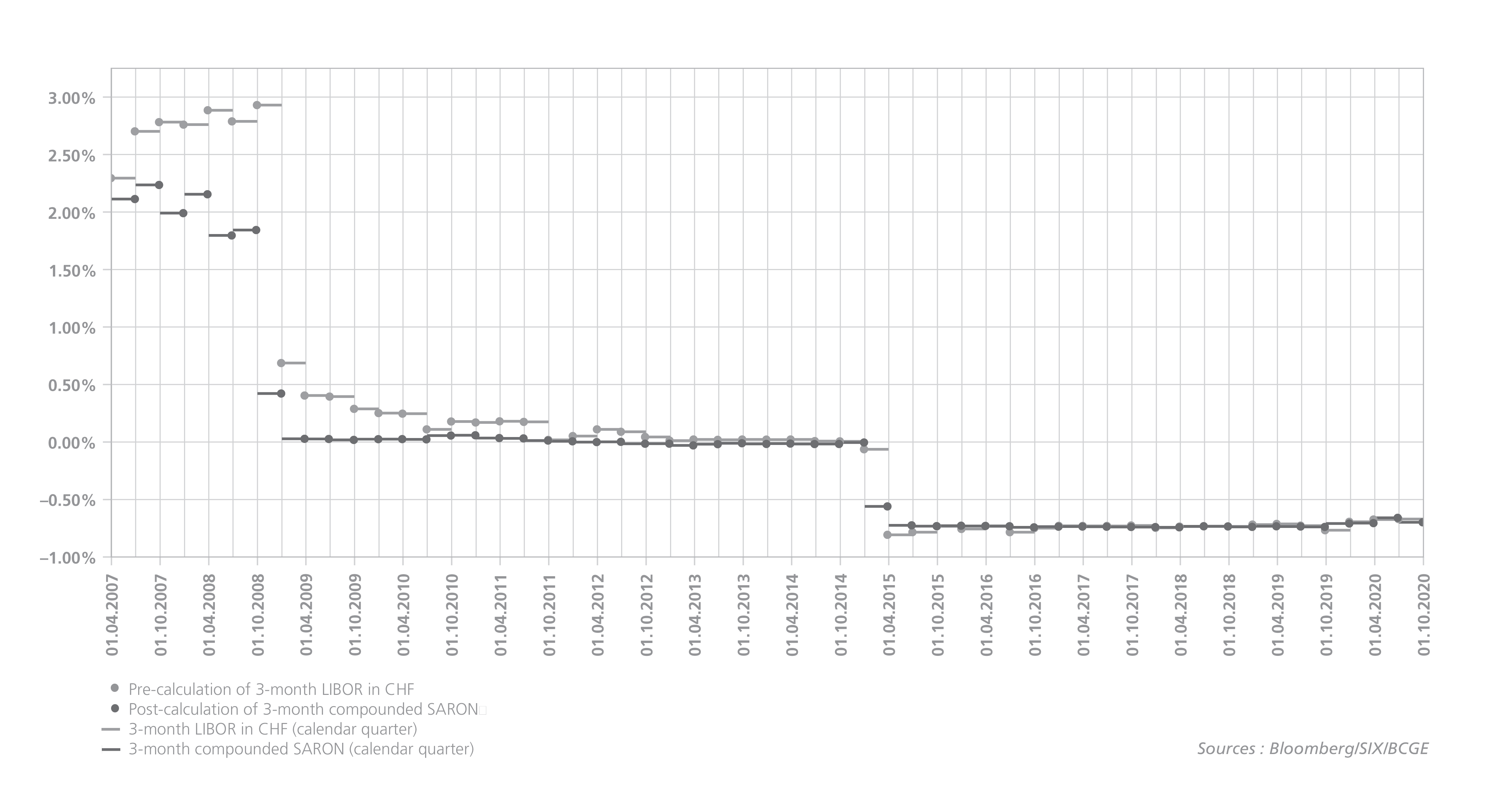

Historical comparison of 3-month LIBOR in Swiss francs and 3-month compounded SARON (Lookback)

- LIBOR replacement: FINMA publishes guidance

- LIBOR panel banks

- Speech from the Financial Conduct Authority

- Illustrative publication of SARON compounded rates by SIX

- International Standards for Benchmarks (IOSCO)

- Benchmark regulation

- Recommendations of the National Working Group

- SARON (Swiss Reference Rates)

- SARON calculator