Stable figures following record result in 2023

Half-year Group results as at 30 June 2024

Ad hoc announcements pursuant to Art. 53 LR

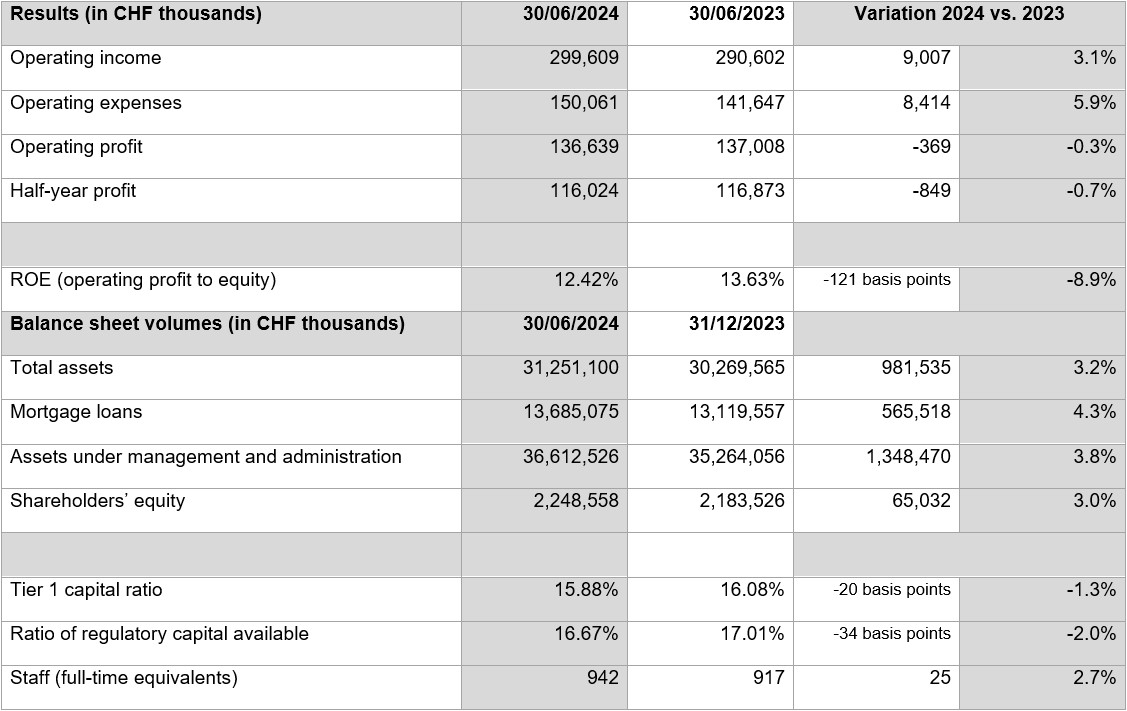

Thanks to excellent business momentum, BCGE can report a stable result after a record year in 2023. Assets under management and administration grew by 3.8% to CHF 36.6 billion, while client receivables and mortgage loans rose by 3.5% to CHF 19.9 billion. Both the operating profit of CHF 137 million (-0.3%) and the net profit of CHF 116 million (-0.7%) proved to be robust. Equity increased by a further 3% to CHF 2.2 billion, with an equity coverage ratio of 16.7%, well above the prescribed 12.7%. The results for the first half of the year reflect the Group’s ability to create lasting value for its clients and shareholders. The annual results for 2024 will be published on 11 March 2025.

Key consolidated figures for the first half of 2024

Resilient operating profit and net profit

Because of its strategic positioning, the Bank was able to benefit from both the domestic and international dynamics of the Geneva economy. Following the record result for the 2023 financial year, the operating profit of CHF 137 million (-0.3%) and net profit of CHF 116 million (-0.7%) proved to be remarkably stable.

The Group recorded an increase in revenues, rising 3.1% to total CHF 300 million. Its revenues are well diversified, with a net interest income of CHF 197 million, a commission income of CHF 73 million and a trading income of CHF 20 million. The 22% share of turnover in EUR and USD demonstrates the international orientation of the BCGE Group’s business lines.

Operating expenses of CHF 150 million (+5.9%) reflect the Bank’s business momentum as it continues to expand its teams and press ahead with its investments in digitalisation, security and the energy transition. The Group’s workforce grew by 25 new positions and now totals 942 employees (full-time equivalents).

An increase in lending

The Bank currently grants corporate and private clients a total of CHF 19.9 billion in loans, which corresponds to an increase of 3.5%. Of this total, CHF 13.7 billion is in mortgage loans and CHF 6.2 billion in other client loans. Mortgage loans account for 44% of the balance sheet total and demonstrate a broad diversification of assets. The Bank serves more than 250,000 clients; among them are 22,489 companies that place their trust in BCGE.

An increase in assets under management and administration

Assets under management and administration rose by 3.8% to CHF 36.6 billion, demonstrating BCGE’s business success. This increase is due in particular to discretionary management mandates and Synchrony investment funds, which account for CHF 15.7 billion of this total. Overall, the inflow of new client assets from private and corporate clients totalled CHF 352 million.

Continued increase in equity capital

Equity rose by CHF 65 million in the first half of the year and currently stands at CHF 2.249 billion. At 16.7%, the consolidated equity ratio is well above the prescribed value of 12.7%. BCGE thus belongs to the circle of well-capitalised banks, as evidenced by the AA-/A-1+/stable rating confirmed by S&P on 27/10/23.

A stable shareholder base

The number of private and institutional shareholders remains stable with 15,233 shareholders at 30 June 2024, including 14,842 private shareholders. The free float is widely distributed, with 83% of shareholders holding between 1 and 50 shares.

A strong rise in share price

BCGE’s share price rose by a whopping 29% in the first half of the year and stood at CHF 290.00 at the end of the reporting period. Market capitalisation is thus gradually approaching the equity value of CHF 312.30.

Outlook for 2024

For 2024, barring a major downturn in the economy, the Bank expects results to be slightly below those of 2023, a record year.