Half-year results as at 30 June 2021

Record net profit

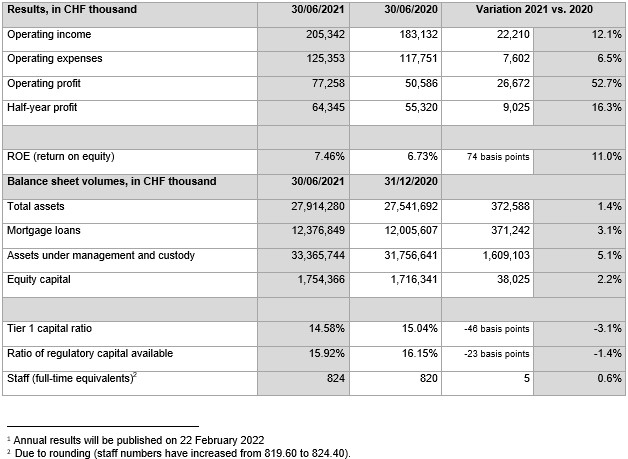

Ad hoc announcements pursuant to Art. 53 LR

Geneva, 10 August 2021 – BCGE posted an excellent economic performance in the first half of the year. Net profit reached a record level of CHF 64 million (+16.3%) and all performance indicators were up. Assets under management and administration reached CHF 33.4 billion (+5.1%), mortgage loans CHF 12.4 billion (+3.1%) and equity capital CHF 1.754 billion (+2.2%). The operating profit on equity is at a very high level at 9% and capital coverage is optimal at 15.9%. Barring a deterioration in the economic situation and taking into account the very positive commercial developments, the bank expects an increase in overall earnings for the year, allowing for growth in equity capital and the dividend1.

Key consolidated figures for the first half of 2021

Turnover continues its strong growth trend

The bank's business model enables it to adapt well to the recovery of the Swiss and international economies. Assets under management and administration rose to CHF 33.4 billion (+5.1%) and mortgage loans to CHF 12.4 billion (+3.1%). Net profit reached a record level at CHF 64 million (+16.3%).

The bank recorded a marked increase in revenues (+12%) thanks to the contribution of all its business lines. Net interest income totalled CHF 104 million and, taking into account the early regulatory provisions for sound loans, reached a total of CHF 126 million1. Commissions rose to CHF 65.8 million (+11%) and trading operations to CHF 17.0 million (+11%). Turnover thus rose to CHF 205.3 million. The share of the Group's turnover in EUR and USD was 28.7%, reflecting the Group's focus on international business. Operating expenses remained under control at CHF 125.4 million and reflect the expansion of the Group, which is digitalising and making the transition to energy-efficient buildings and recruiting in cutting-edge areas. The Group's workforce grew by 27 new positions over the year to reach 824 employees (in full-time equivalents).

BCGE: a major contributor to the financing Geneva's economy

The bank grants loans worth CHF 18.2 billion to companies and private individuals. Since 31 December 2020, an additional 255 businesses have joined the ranks of clients, bringing the total to 20,864 businesses (legal entities). Mortgage loans increased by a targeted CHF 12.4 billion (+3.1%). Their share in the balance sheet total is moderate (44.3%), reflecting a disciplined risk diversification policy.

Increase in assets management and administration

Assets under management and administration rose to CHF 1.6 billion to reach the significant milestone of CHF 33 billion. Private clients were the main contributors to this remarkable growth, and private banking registered 1,053 new Best of management mandates during the half-year. Synchrony investment funds reached CHF 3.7 billion.

Equity capital continues to increase

Equity capital increased by CHF 38 million (+2.2%), bringing it to CHF 1.754 billion. The consolidated equity capitalisation ratio is close to 16%. The bank belongs to the group of well-capitalised and secure banks, as reflected in its A+/Positive/A-1 rating, which was confirmed in 2021.

340 new shareholders

The number of private and institutional shareholders has been growing year on year, reaching 15,408 on 30 June. The floating part of the capital is widely distributed as 83.3% of shareholders hold between 1 and 50 shares.

The BCGE share price grew by 8.5%

The BCGE share price ended the half year period at CHF 172.50. The potential for growth remains high, since compared to the level of equity capital, the intrinsic value of the share stands at CHF 246.92.

Strategic priorities for 2021

The strategic priorities that guide the BCGE’s development are as follows:

- Core partner for the regional economy and SMEs.

- Key player in the financing of private and social housing in Geneva.

- Recognised experience in advisory services for Swiss and international private banking.

- Expert in asset management and investment funds.

- Beacon for the influence of Geneva's economy and trade in Switzerland and around the world.

- Innovative leader in bank digitisation.

- Partner to corporate and private clients in the energy transition process.

Outlook for 2021

The bank is stepping up the pace of business expansion, backed by the recovery of the Swiss and international economies. Its current impetus is based on the diversity of its skills and on the suitability of its business model to the demands of its clients.

- The growth of high added-value business and the loyalty of its client base reaffirm BCGE’s favourable strategic positioning.

- The bank's financial strength makes it a safe and stable custodial address.

- The bank expects low interest rates and a deteriorated economic climate to continue, factors which are likely to affect its interest margin and commission revenues.

- The increase in lending remains moderate due to the regulations governing capital requirements and a policy of caution.

- The bank is promoting the development of its less capital-intensive businesses (private and institutional asset management, corporate advisory services, private equity).

Barring a deterioration in the economic situation and taking into account the very positive commercial developments, the bank expects an increase in overall earnings for the year, allowing for growth in equity capital and the dividend.

1 Based on the excellent results of the first half of the year, the bank has decided to anticipate the regulatory provisions of sound loans / Expected Credit Losses allocation of CHF 25.6 million in full. See the notes to the financial statements for more details.