2024 Annual Results

Outstanding 2024 results

Ad hoc announcements pursuant to Art. 53 LR

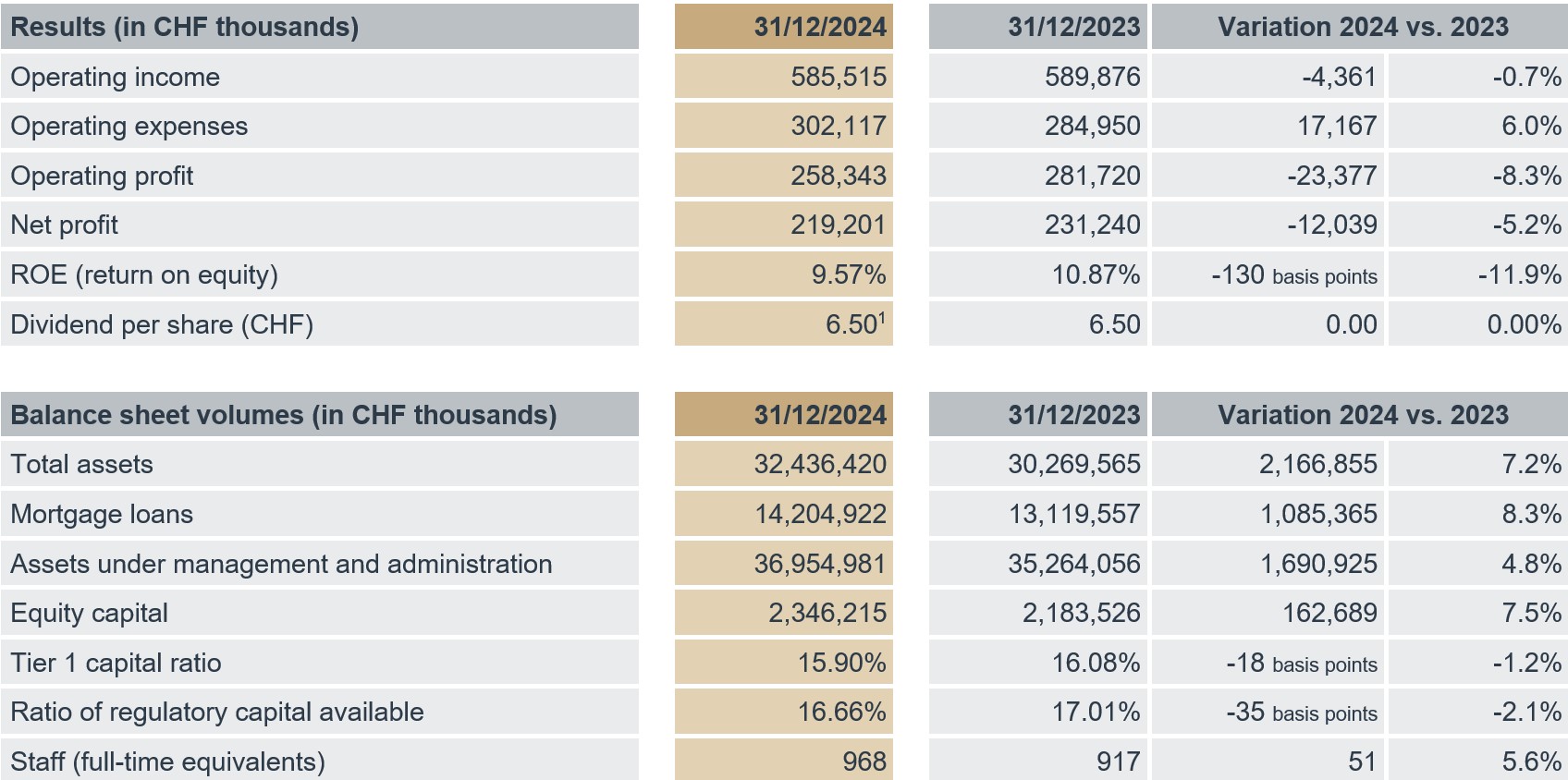

The year-end results for 2024 reflect BCGE Group’s strong commercial growth, thanks to which the Group was able to post a turnover close to the record results achieved in 2023. Assets under management and administration increased by 4.8% to CHF 37 billion, while amounts due from clients and mortgage loans rose by 7.1% to CHF 20.6 billion. At CHF 258 million (-8.3%) and CHF 219 million (-5.2%) respectively, both operating and net profit remained very strong. Equity capital increased by a further 7.5% to CHF 2.3 billion, with an equity coverage ratio of 16.7%, well above the regulatory requirement of 12.7%. At CHF 6.50 per share, the dividend proposed to the General Meeting of Shareholders will remain unchanged compared with last year’s dividend. For 2025, the Bank is being cautious in its forecasts. It expects lower earnings according to interest rate trend.

Main consolidated figures for the 2024 financial year

Second best result in the Group’s history

Turnover was slightly down by 0.7% at CHF 586 million, due to the Group’s selective expansion of business volumes. Revenues are well diversified, with a net interest income of CHF 377 million (-3.3%). Commissions hit a new record at CHF 148 million increasing by 11.2%, while trading operations rose by 9.3% to CHF 42 million. The 23.4% share of turnover in EUR and USD reflects the international orientation of the BCGE Group’s business lines.

The increase in operating expenses to CHF 302 million (+6.0%) is the result of ongoing investment dynamics and the expansion of the workforce. At 51.6%, the cost/income ratio is in line with the long-term objectives. The number of the Group’s employees rose by 51 to 968 (in full-time equivalents).

Boosted by the Group’s commercial growth, both operating and net profit remained remarkably high, at CHF 258 million (-8.3%) and CHF 219 million (-5.2%) respectively, despite an unfavourable interest rate environment.

Strong growth in loans

Loans granted to companies and individuals increased by 7.1% to CHF 20.6 billion, CHF 14.2 billion of which are mortgage loans and CHF 6.4 billion other amounts due from clients. Mortgage loans account for 44% of the balance sheet total and demonstrate the broad diversification of assets. The Bank serves more than 254,000 clients, including 22,756 companies (an increase of 664 over the last year), all placing their trust in BCGE.

Increase in assets under management and administration

Assets under management and administration rose by 4.8% to CHF 37 billion, demonstrating BCGE’s positive business momentum. This increase is due in particular to discretionary management mandates, investment funds and client deposits. Overall, the inflow of new client assets from private and corporate clients (net new assets) totalled CHF 228 million.

Continued increase in equity capital

Equity capital rose by CHF 163 million over the last year and currently stands at CHF 2.346 billion. At 16.7%, the consolidated equity ratio is well above the regulatory requirement of 12.7%. As a result, the Bank boasts a robust risk profile, which is reflected in its AA-/A-1+/stable rating (confirmed by S&P on 29.10.2024).

Rising share price

BCGE’s share price rose by 13.3% in 2024 closing the year at CHF 255. Market capitalisation remains below the intrinsic value of CHF 326 per share in relation to equity capital. The number of private and institutional shareholders remains stable with 15,207 shareholders as at 31 December 2024. The free float is widely distributed, with 83% of shareholders holding between 1 and 50 shares.

Outlook for 2025

For 2025, the Bank is being cautious in its forecasts. It expects lower earnings according to interest rate trend.

[1] proposal to be submitted to the General Meeting of Shareholders on 29 April 2025