ForXchange by BCGE

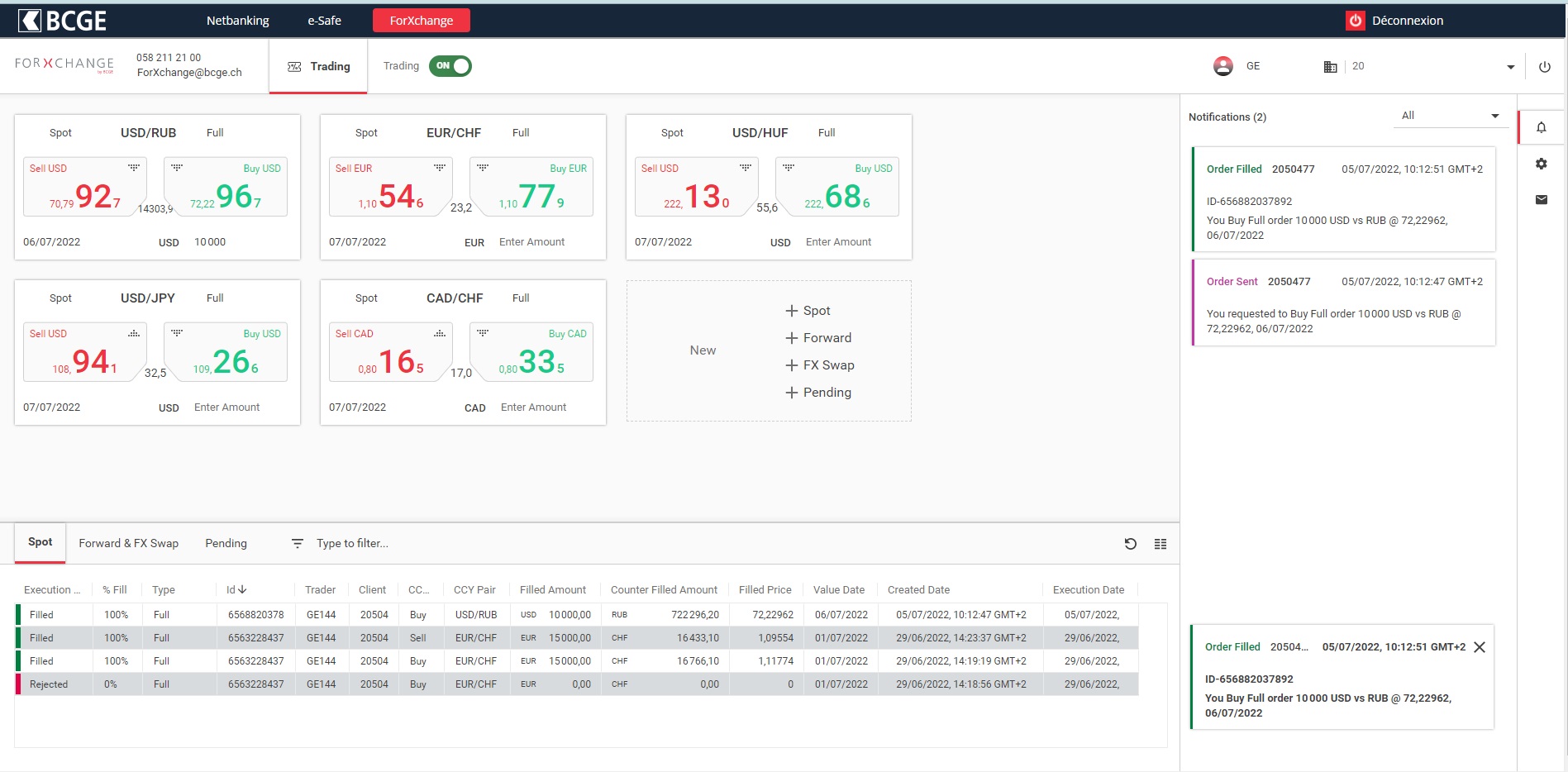

BCGE's ForXchange platform is designed to fit the needs of companies carrying out foreign exchange transactions. It ensures autonomous and secure execution of the foreign exchange transactions.

A foreign exchange solution allowing real-time execution

A tool that immediately posts foreign exchange transactions to the account

A platform offering an extended panel of order types to fit the needs of most companies

Online Access

Many companies, no matter the size, deal with foreign currencies when they are active beyond their borders or when they import and export products and services. ForXchange by BCGE is an innovative solution adapted to corporate transactions. Companies have access to real time interbank liquidity and have it delivered on their accounts under BCGE conditions.

Advantages

A competitive platform

ForXchange by BCGE processes the most widely traded currency pairs on the foreign exchange market, including the Swiss franc, the euro, the dollar (US and Canadian), the pound sterling and the Japanese yen, as well as precious metals (gold, silver, platinum, palladium). Orders are executed in real time and are immediately posted to your accounts. With ForXchange, you benefit from one of the best current exchange rates depending on the transaction and your user profile.

Real-time execution of your spot, forward and swap transactions

Exchange rates are the result of the simultaneous purchase and sale of two separate currencies called "currency pairs". They reflect the economic context, interest rate developments, international trade and speculative activity. Real-time access to market exchange rates allows you to take advantage of their variations. You can also protect yourself against possible adverse price movements by hedging. This helps you to manage your exchange rate risks more easily.Posted directly to your BCGE account

As opposed to online brokers, BCGE allows you to post your foreign exchange transactions directly to your BCGE accounts. To buy or sell one currency against another, you simply need to have accounts in each of these currencies with our bank. You can use the available amounts (cash and credit) to carry out your transactions. In addition, you instantly have an overview of your spot transactions from your online solutions in Netbanking.

Autonomy, speed and flexibility

Easy to use, the platform is modular and adapted to your needs; in order to view the best offered exchange rates and buy the underlying liquidity, you just select the currency pair, the amount and the delivery date that concerns you.

You can access ForXchange directly from your client area integrated into your Netbanking. You only need to log in once and there is no need for any installations. The ForXchange environment can also be shared between several Netbanking users.

The platform provides powerful and customisable transaction tracking. In addition, it offers an optimised interface and easier navigation.

Further information

Available currencies and metals

| Name of the currency | Symbol | Name of the currency | Symbol |

|---|---|---|---|

|

Swiss franc

|

CHF

|

Danish krone1

|

DKK

|

|

Euro

|

EUR

|

Hong Kong dollar1

|

HKD

|

|

US dollar

|

USD

|

Norwegian krone1

|

NOK

|

|

Pound sterling

|

GBP

|

New Zealand dollar1

|

NZD

|

|

Japanese yen

|

JPY

|

Swedish krona1

|

SEK

|

|

Australian dollar1

|

AUD

|

Singapore dollar1

|

SGD

|

|

Canadian dollar

|

CAD

|

South African rand1

|

ZAR

|

¹ On request from your adviser

Depending on market practice, our entire range of precious metals can be traded in ounces against USD via precious metal accounts.

Depending on market practice, our entire range of precious metals can be traded in ounces against USD via precious metal accounts.

| Precious metals | Symbol | Precious metals | Symbol |

|---|---|---|---|

|

Gold

|

XAU

|

Silver

|

XAG

|

|

Palladium

|

XPD

|

Platinum

|

XPT

|

Possible operations

| Spot transaction* | Forward outright transaction | Swap transactions** | Limit orders |

|---|---|---|---|

|

Buying or selling one currency against another:

|

Buying or selling one currency against another at the market rate.

Deferred delivery date, requiring a limit for forward foreign exchange transactions. |

Back and forth transaction mixing either spot and term transactions or only term transactions. These are meant for:

|

Purchase or sale of a currency against another at a predefined price. ForXchange monitors the market 24 hours a day, 5 days a week for automatic execution if the price is reached.

|

* In standard market practice, a spot transaction is posted immediately with a maturity of 2 business days. According to the currencies and market liquidity, the ForXchange platform enables you to have same-day or one-day maturities.

** Swap points are the difference between the two currencies interest rate spreads on the holding period.

Contact us

For all technical questions concerning use of the forex platform, our helpline is available from Sunday midnight to Friday 7.30 pm.

Contact us

** Swap points are the difference between the two currencies interest rate spreads on the holding period.

Contact us

Administrative support

For all administrative questions linked to passwords and concerning access to the forex platform, our helpline is available from Monday 7.30 am to Friday 7.30 pm.Contact us

- By telephone : 058 211 21 00 (calls are recorded)

- By e-mail

Technical support

For all technical questions concerning use of the forex platform, our helpline is available from Sunday midnight to Friday 7.30 pm.Contact us

- By telephone : 058 211 21 22 (calls are recorded)

- By e-mail : ForXchange@bcge.ch

You can also consult

A question?

Contact us