Check-up

Check-up is a structured interview that enables you to check the health of your finances. The personalised financial advice provided is designed to structure your assets according to your profile.

A comprehensive analysis of your financial health

Your asset pyramid with personalised financial recommendations

The presentation of your economic profile

A pension estimate for your retirement

The essentials

A pedagogical approach to structuring your finances

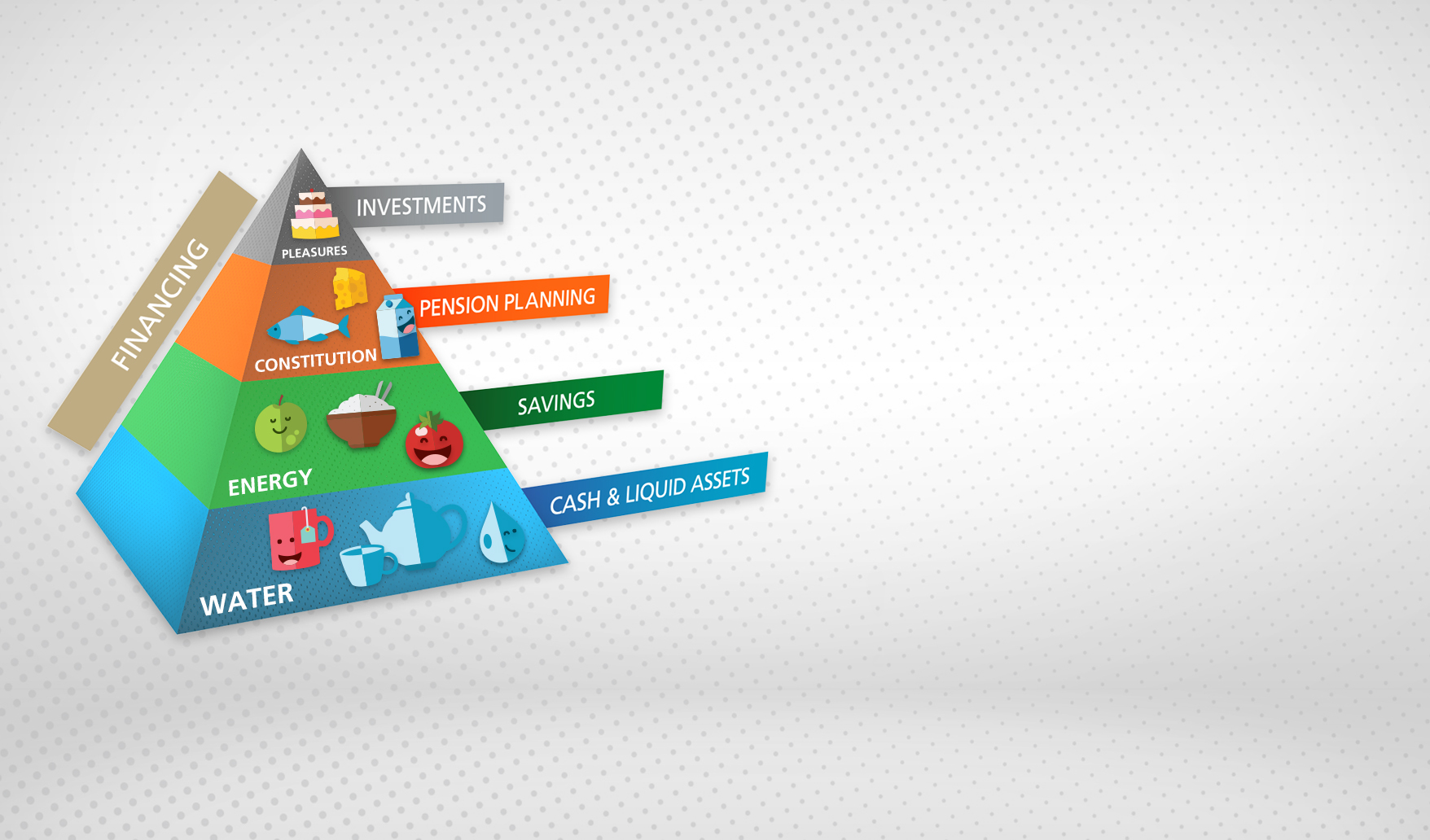

To assist you in the major financial decisions of your life, Banque Cantonale de Genève has developed a wealth management philosophy that draws its inspiration from the science of dietetics. The aim of this philosophy is to organise your assets using the same model as the food pyramid.

We have opted for a "financial" pyramid in order to convey our approach to wealth management in a concise manner. Our approach encompasses everything from cash in private accounts to financial investments, while also ensuring that savings and retirement requirements are met beforehand.

The key principles to adhere to are:

- Have sufficient cash at all times.

- Build a good savings balance to quickly mobilise additional cash.

- Build up a comfortable and tax-efficient pension reserve.

- Set up an investment strategy tailored to your investor profile.

- Finance personal projects without exceeding the potential debt.

Have you ever checked the health of your finances?

The Check-up introduces the principles of sound management to ensure long-term financial security.

With a financial Check-up, you can carry out an in-depth analysis of your financial situation in order to build your own wealth pyramid.

During a one-on-one meeting with your client adviser, you identify possible imbalances, obtain a report with personalised recommendations in order to harmonise your finances according to the Check-up standards.

The personalised financial advice provided is designed to enable you to build, protect and invest your assets in a profitable manner according to your profile so that you can carry out your projects.

The first step is to prepare for your retirement

Pension planning is at the heart of the financial Check-up, which includes an assessment of your asset and income situation during your second active life. As part of the review of all assets, the pension certificate is also explained in detail and an analysis of the existing possibilities is carried out. If necessary, the analysis can be supplemented by the Pensions Advisory and Financial Planning Unit.

Check-up enables you to carry out a first level pension analysis with:

- A pension estimate for your retirement which includes AVS, 2nd pillar and other known income.

- The definition of any additional capital to meet the estimated financial needs for retirement.

- The analysis of the potential buyback in the 2nd pillar.

Contact a client adviser for your Check-up

To carry out a complete financial assessment and analyse the implementation of your project, you can contact our client advisers today on 058 211 21 00 or make an appointment using our contact form.

Conditions

- The minimum age for a Check-up is 18 years old.

- You will need to bring your latest pension certificate.