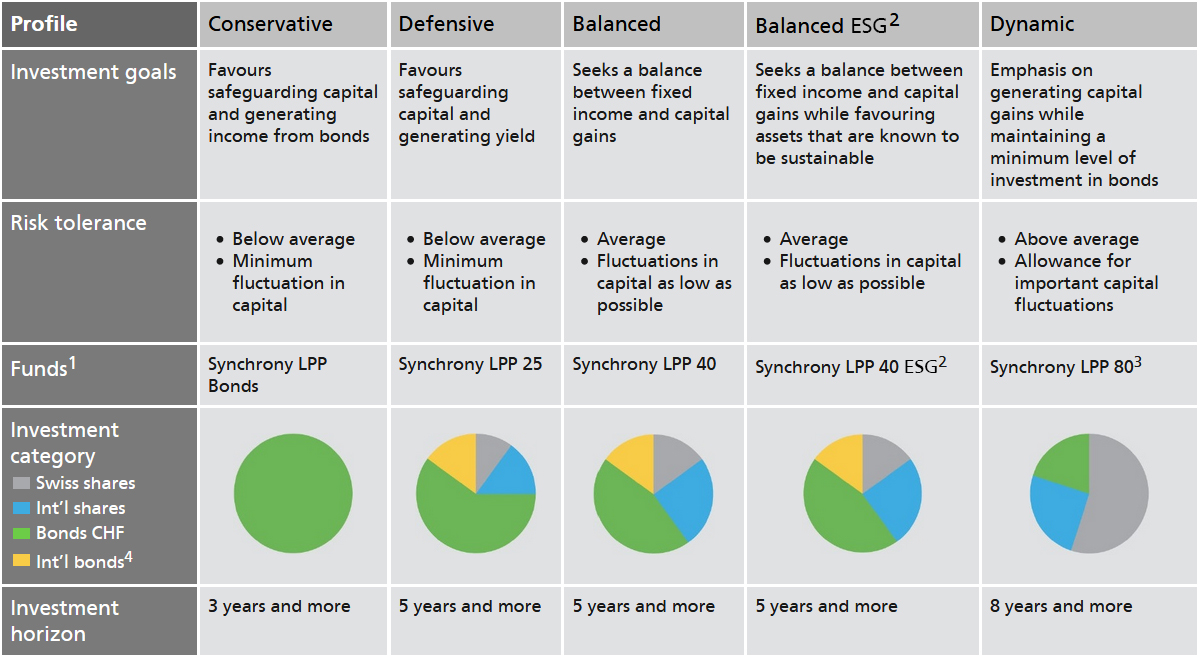

Synchrony LPP Funds

You have the option of investing all or part of your 2nd or 3rd pillar a pension assets in Synchrony LPP funds.

Discover the multi-manager investment funds

Synchrony LPP funds, which are adapted to your risk profile and time horizon, aim to facilitate the steady growth of your capital in strict compliance with the legal framework for pension funds.They are managed by professionals who monitor, day after day, the performance of the investments made and the evolution of the financial markets.

-

Because of the bond positions, investment funds are affected by movements in interest rates. Fluctuations in value may also occur because of their exposure to equities.

-

ESG – Environmental, Social and Governance

-

Share allocation of the Synchrony LPP 80 fund may reach or even exceed 80%, which is in line with the Swiss legislation on occupational benefits plans (OPP2) and represents a higher proportion than those encountered in traditional provision funds. The fund may experience important value fluctuations due to its high share exposure. This fund is suited for investors with a long or very long term investment horizon and a high risk tolerance.

-

International bonds: in accordance with OPP 2, the proportion in foreign currencies without currency hedging may not exceed 30%.

Note: The Synchrony LPP 80 fund is not available for the investment of vested benefit assets.

Documents : Find all the factsheets, KIID and Regulations