Pensions Advisory and Financial Planning Unit

Your life is marked by important events, sometimes unforeseen, that have a direct or indirect impact on your financial situation. The latter inevitably raise questions about sometimes complex issues to which precise answers must be provided.

The essentials

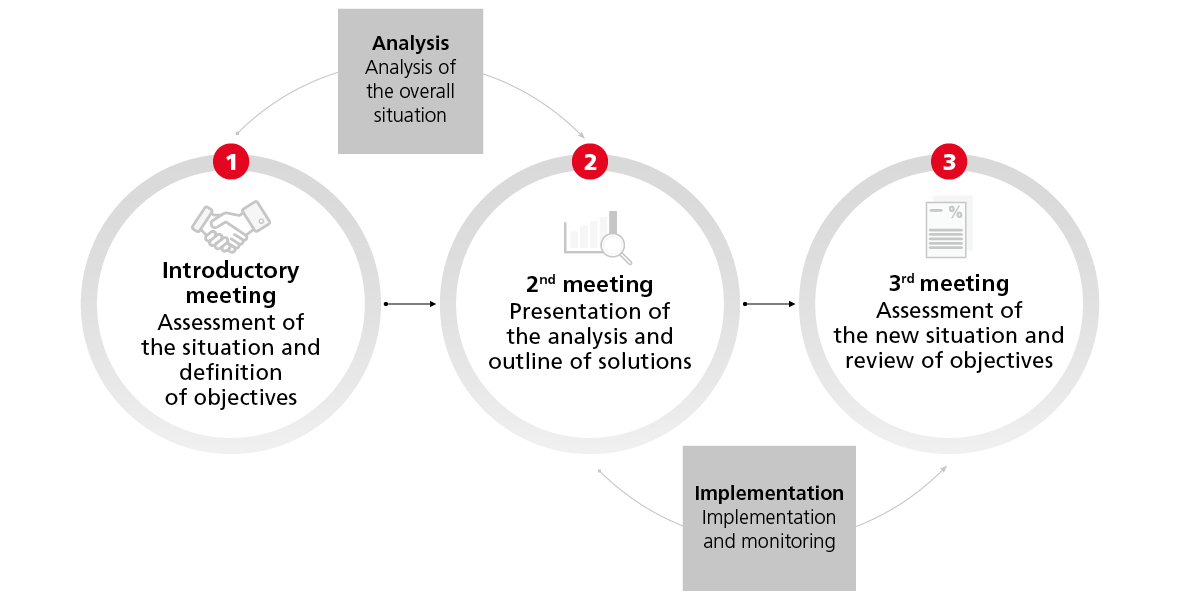

BCGE offers you the BCGE Praevisio concept. It is based on a thorough analysis of your personal situation and, if necessary, a selection of the best pension products on the market in complete Independence.

What is financial planning?

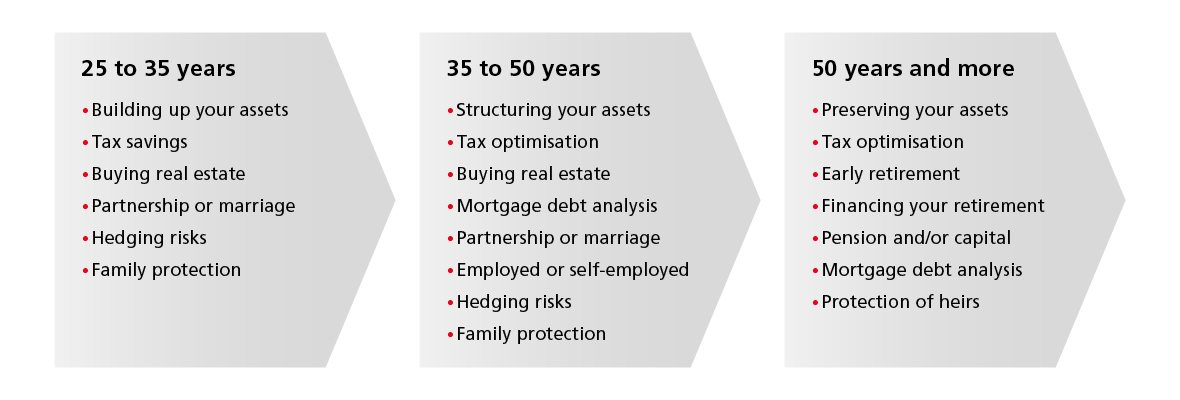

A financial plan consists of taking stock of your overall financial situation and estimating its probable evolution in the medium and long term. It takes into account several key subjects:

Further information

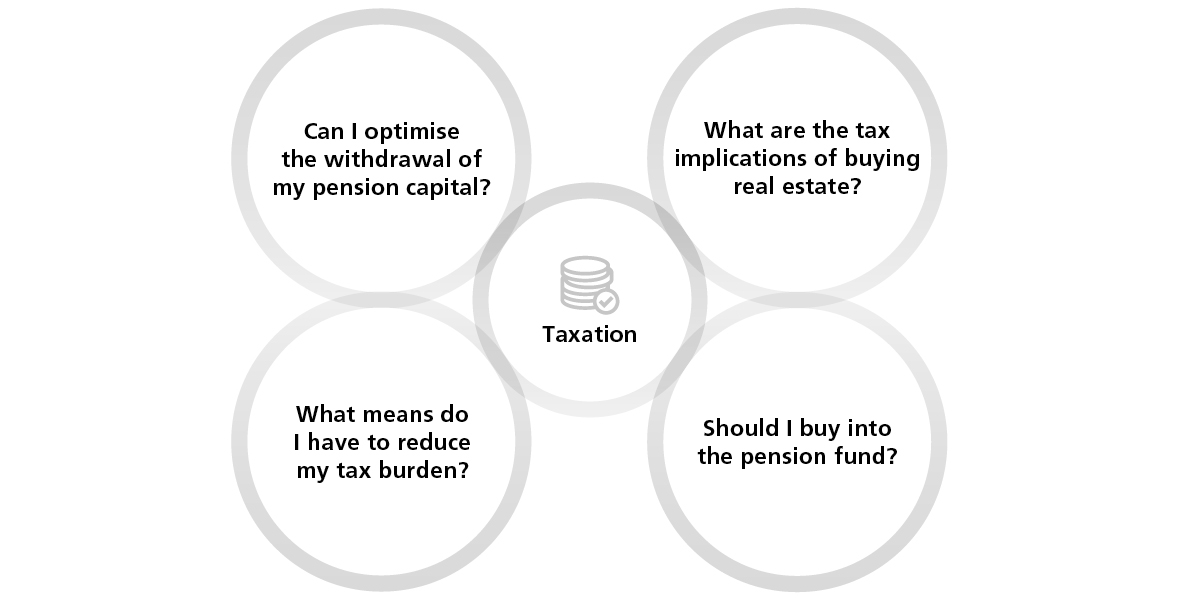

Many decisions have tax implications. The better you know them, the better you can optimise your tax situation.

What is our advisory approach?

Tarification

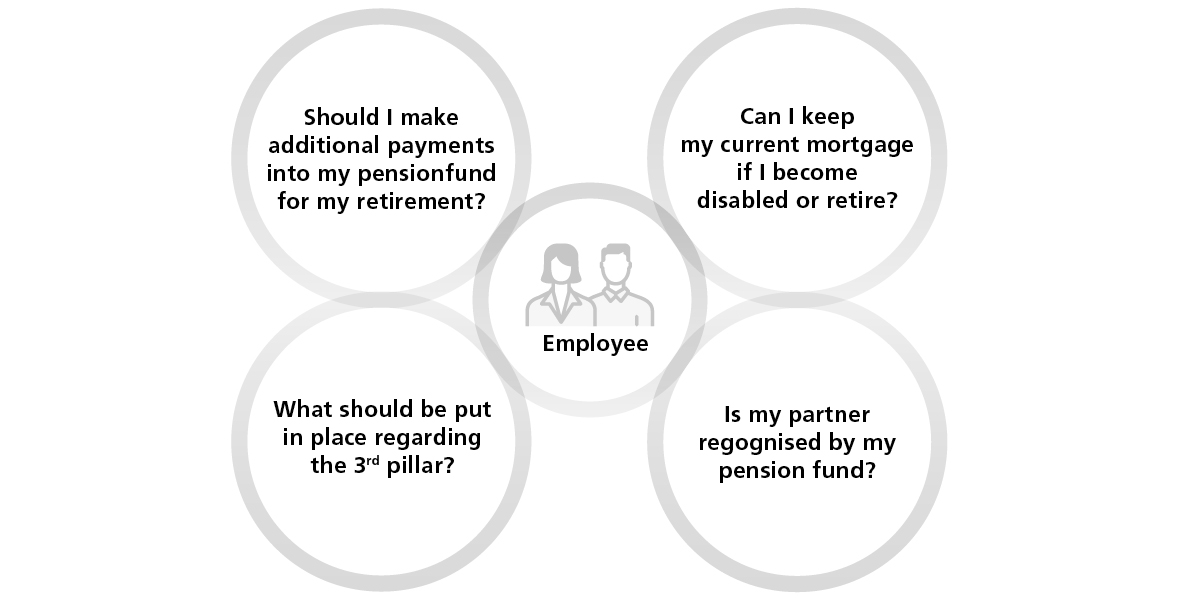

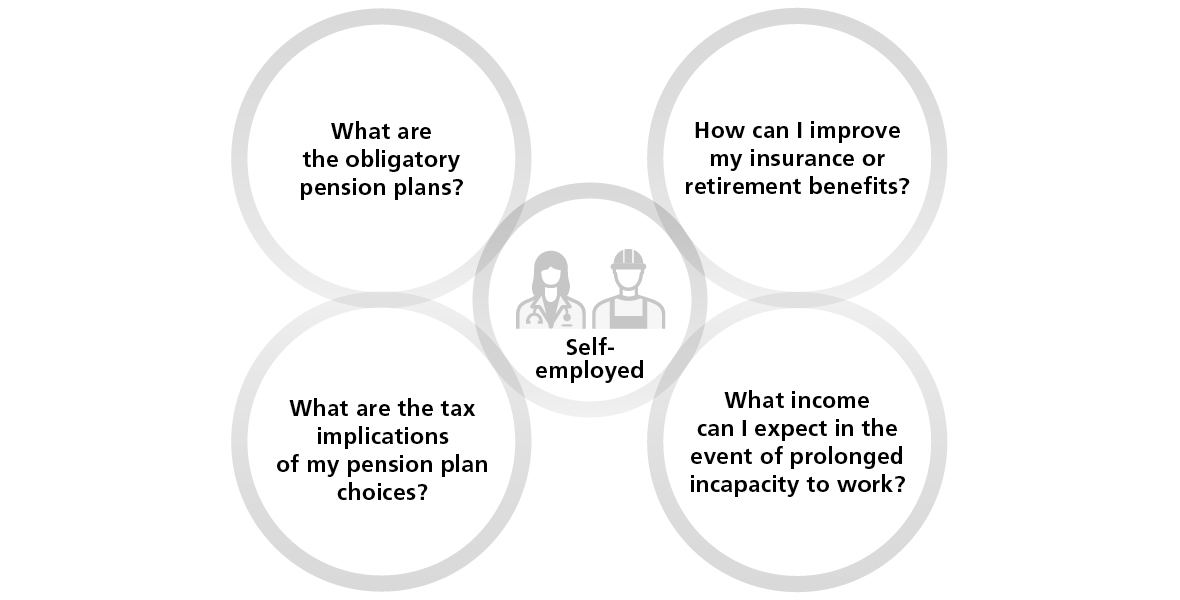

Some of the subjects often discussed:

- Effective cost of mortgage debt

- Buying into the pension fund

- Marginal tax rate

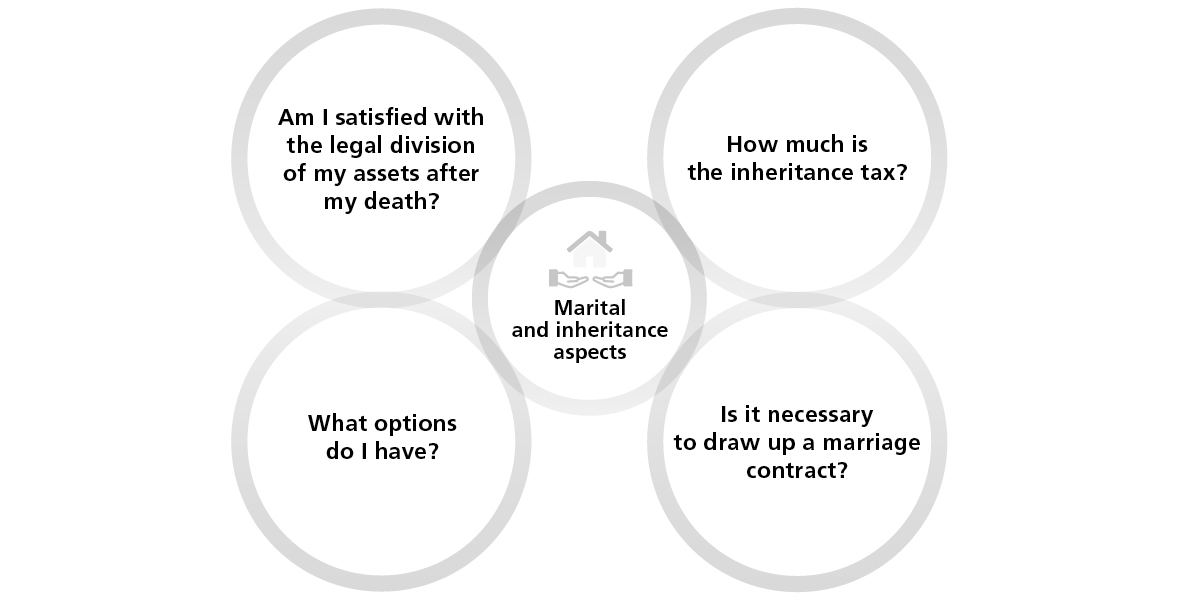

- Benefits in the event of succession

- Financial consequences of a divorce

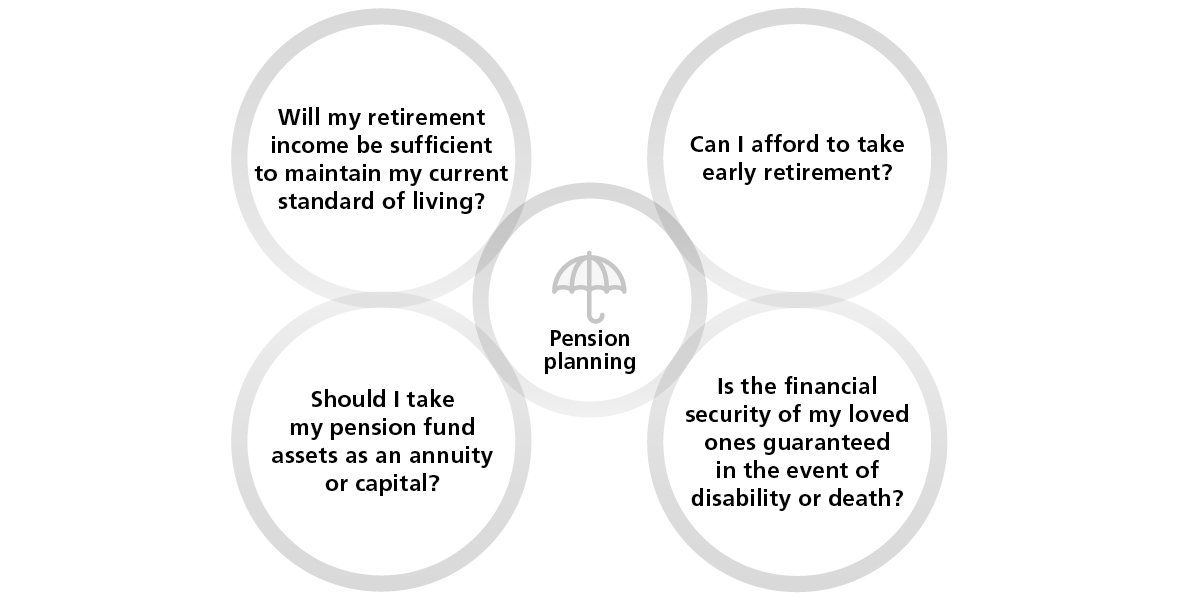

Analysis of all types of insurance and pension benefits (3-pillar system) for temporary incapacity for work, disability, death and retirement. This analysis is all the more important in the case of home ownership.

Solutions are then proposed to fill any gaps while optimising taxation.