Pensions Advisory and Financial Planning Unit

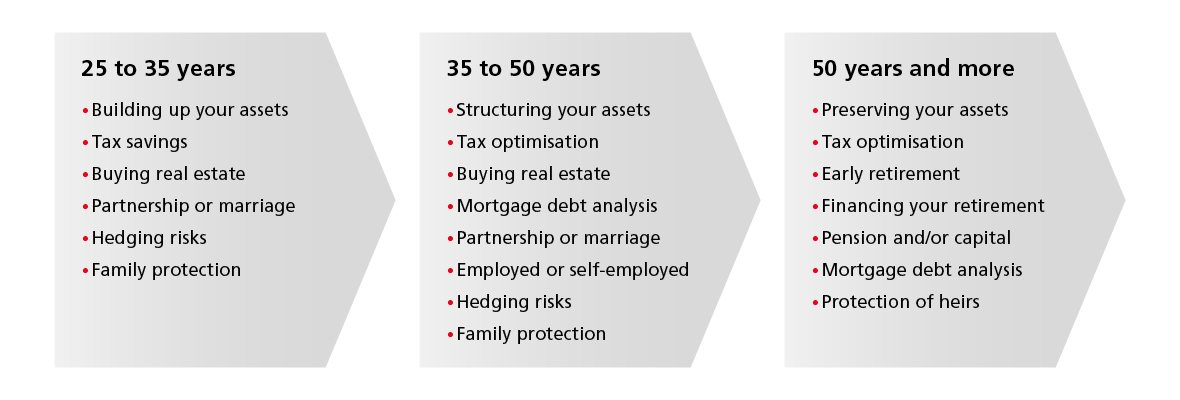

Your life is marked by important events, sometimes unforeseen, that have a direct or indirect impact on your financial situation. The latter inevitably raise questions about sometimes complex issues to which precise answers must be provided.

The essentials

BCGE offers you the BCGE Praevisio concept. It is based on a thorough analysis of your personal situation and, if necessary, a selection of the best pension products on the market in complete Independence.

What is financial planning?

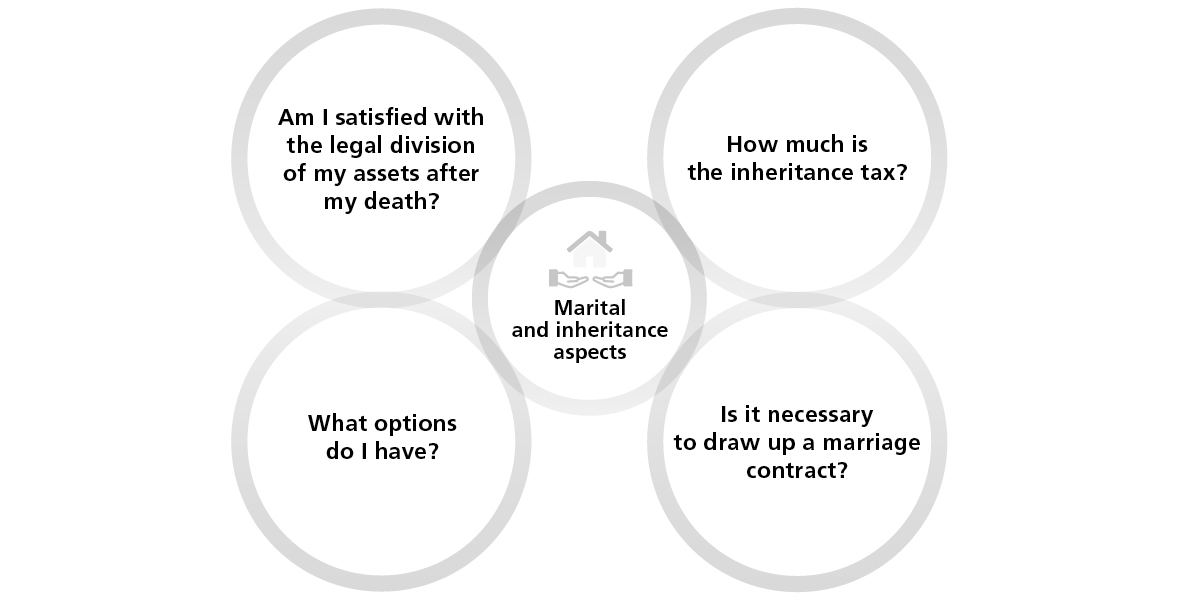

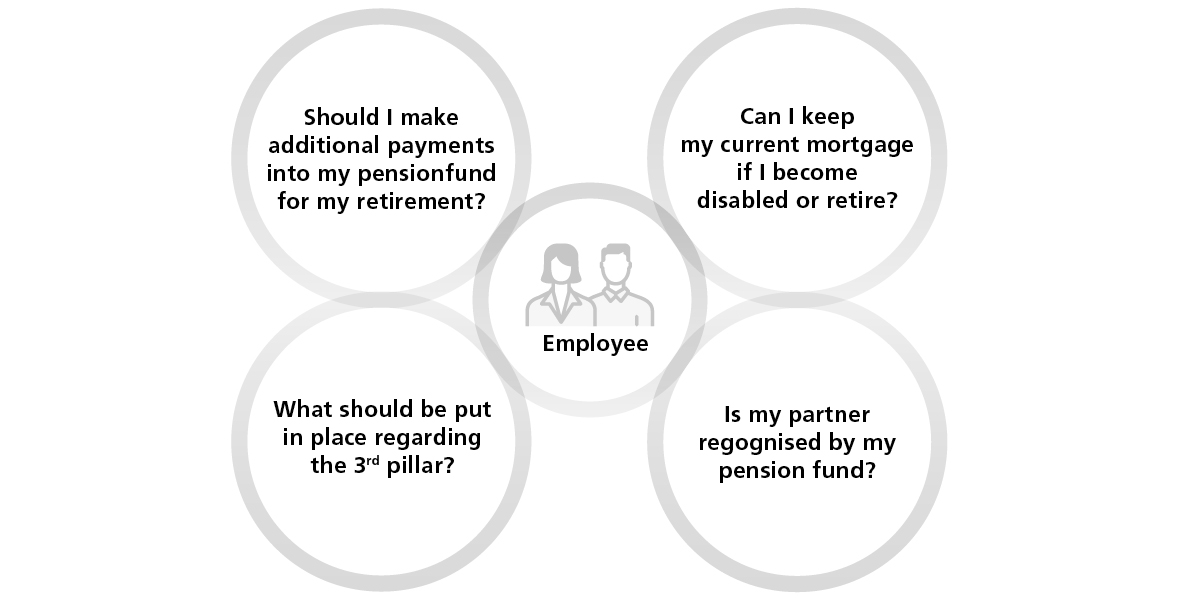

A financial plan consists of taking stock of your overall financial situation and estimating its probable evolution in the medium and long term. It takes into account several key subjects:

Further information

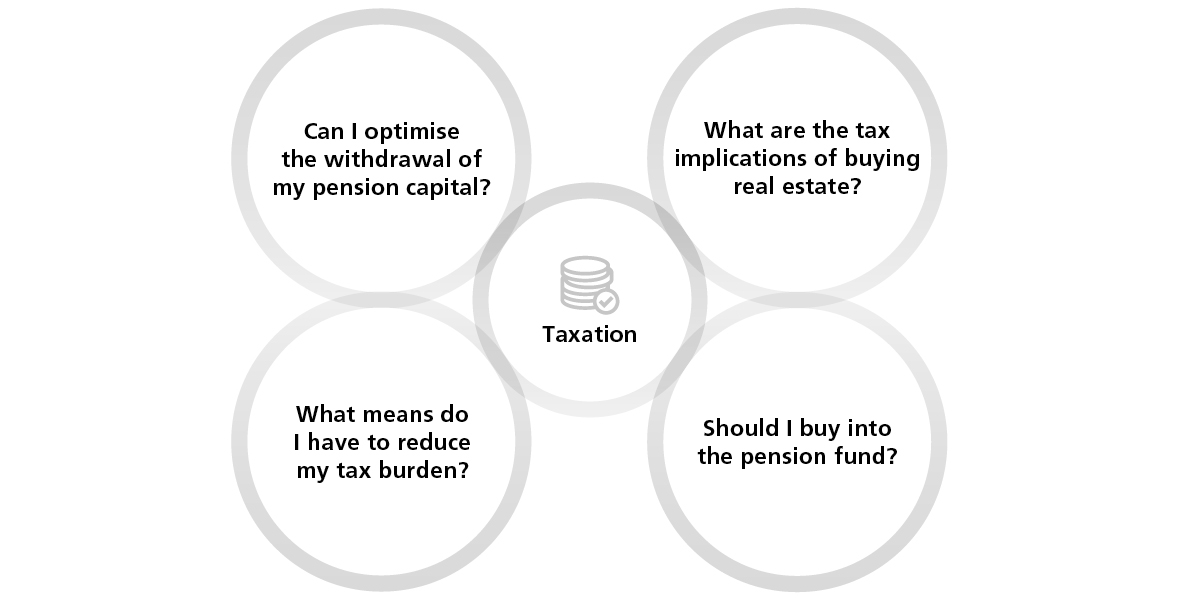

Many decisions have tax implications. The better you know them, the better you can optimise your tax situation.

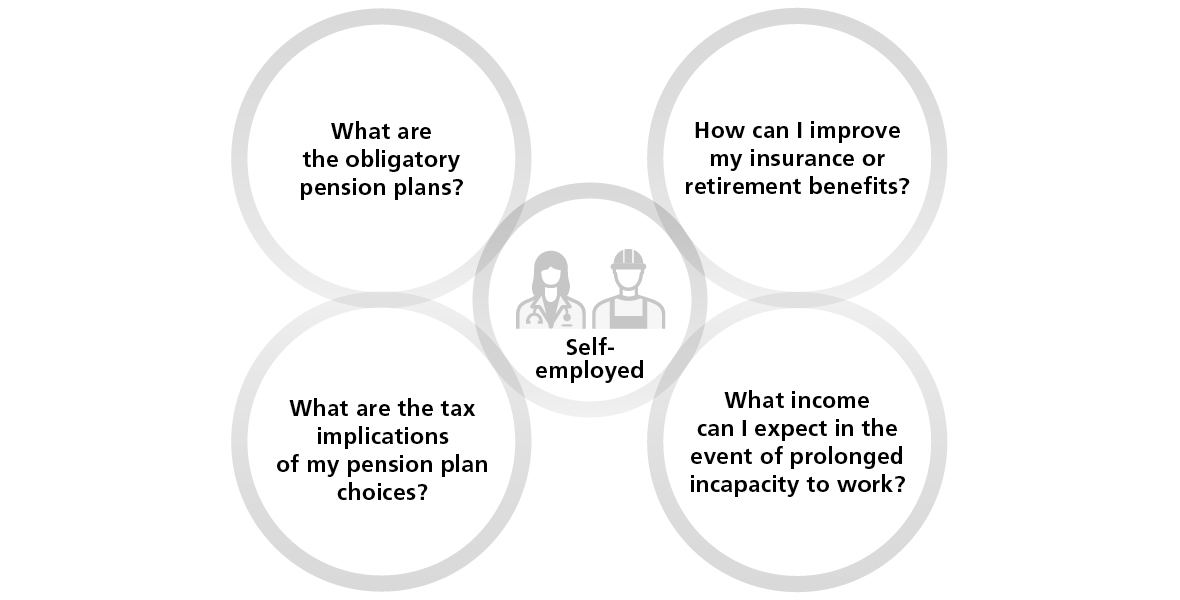

Occupational pension planning: an important asset for business owners

Whether you are self-employed or the head of an SME, it is essential that you analyse in advance the pension benefits to which you and your employees ...

Discover